Deduction checklist *certified specialist in taxation law, state bar of california board of legal. But let’s start with the top 14 teacher tax deductions:

Fresno teachers association income tax deductions 2021 full calendar year

Tax deductions for teachers 2021. But let’s start with the top 14 teacher tax deductions: For federal income tax purposes, you can take a deduction for your sales tax or state income tax. You can claim a deduction when you:

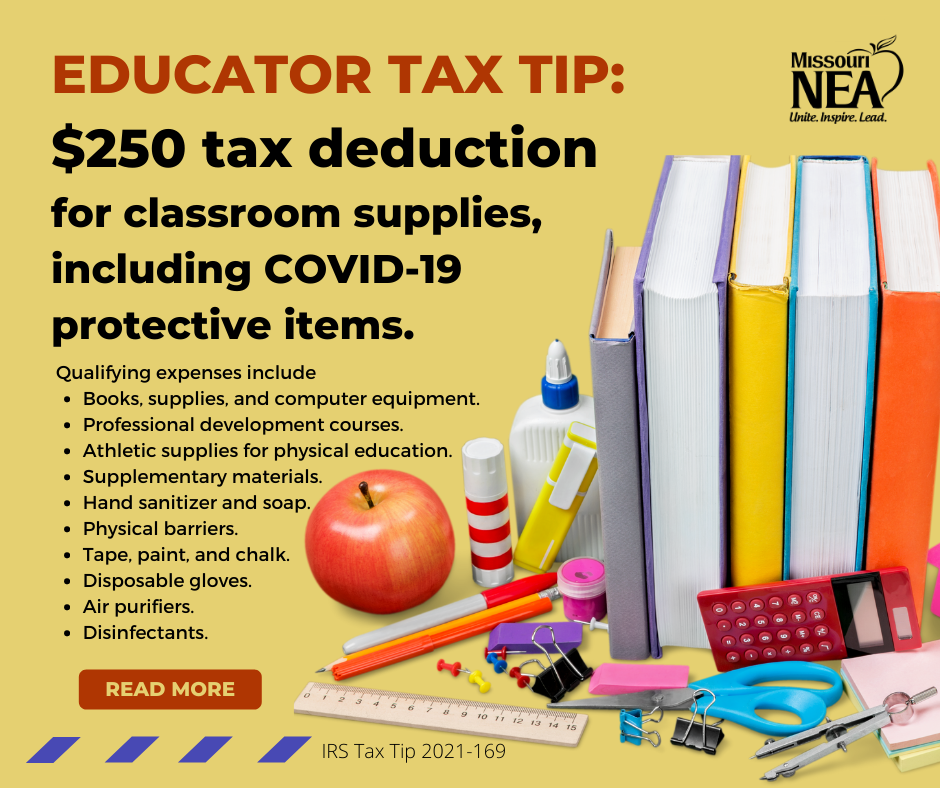

The methods available for tax time 2021 are: A teacher can deduct a maximum of $250. The educator expense deduction allows eligible teachers and administrators to deduct part of the cost of technology, supplies and training from their taxes.

A teacher’s aid to being a teacher. If you were an eligible educator you can claim up to $1,000 of eligible teaching supplies expenses. If you earn your income as a teacher or education professional, this information will help you to work out what:

Income and allowances to report; It is very important for you to give money to charity. In turn, this will reduce your overall taxes, increase your refund, and decrease the taxes you owe.

Your work outfit has to be specific to the work you do as an educator or teacher. Here are just a few examples of items that can be deducted for the educator expense deduction • school supplies • books. Deduction checklist *certified specialist in taxation law, state bar of california board of legal.

What is the educator expense deduction? For those unfamiliar, tax deductions are kind of important as they can reduce your adjusted gross income or agi. Costs associated with health insurance.

The educator expense deduction for 2021 taxes in 2022. There’s nothing unusual about business expenses. The new law clarifies that unreimbursed expenses paid or incurred after march 12, 2020, by eligible educators for protective items to stop the spread of.

Reducing your educator expense deduction. And, yes, if you are married and both of you are educators, you can double your deduction for a total of $500. Keep track of your expenses.

Now, there are two deduction methods you can employ. Two married teachers filing a joint return can take a deduction of up to $250 apiece, for a maximum of $500. Educator expense deduction if you�re a teacher, instructor, counselor, principal or classroom aid, you may be able to deduct up to $250 in unreimbursed expenses for the classroom.

Educators can deduct up to $250 each in eligible expenses on their taxes. No longer dependents for 2021 _____ _____ if your bank account for direct deposit of any refund has changed since. Learning is a lifetime process.

This deduction allows eligible educators to deduct unreimbursed expenses related to education. Claiming tax deductions teachers can claim the educator expense deduction regardless of whether they take the standard deduction or itemize their tax deductions. Eligible educator you are considered an eligible educator if, at any time during the 2020 tax year, both of the following conditions are met:

They can only claim this deduction for expenses that were not reimbursed by their employer, a grant or other source. Qualified expenses include books and supplies used in the. Additionally, you should anticipate some new deductions on your taxes for 2021.

Find out about teachers and education. Records you need to keep. For example, uniforms, school required shirts,.

4 common tax deductions for teachers and other educators. No dues were collected during august or september. This deduction is particularly advantageous because it’s above the line on schedule a, which means eligible educators don’t have to itemize to take it, and it reduces your overall adjusted gross income (agi).

In most cases, these items can become valuable tax deductions for teachers. Fresno teachers association income tax deductions 2021 full calendar year If you were not employed for the full year it is necessary for you to make appropriate modifications to the above figures.

1 day agohow do you get tax deductions?