Your expenses might be different than if you were in your home country, so be sure to be diligent about keeping track of all expenses on a spreadsheet along with receipts so. The deduction was up to $4,000 above the line, but barring new legislation, it is no longer available.

You can find details on the government of canada’s page for eligible educator school supply tax credit.

Tax deductions for teachers canada. Teacher and early childhood educator school supply tax credit. A tax deduction is any business expense that is both essential to your work (aka teaching yoga) and. The tuition and fees education tax deduction expired on dec.

This product starts with an overview of how your tpt earnings are used to figure your taxes. You must pass the tests and get recommended by the college when complete. Books, stationery, supplies, computer equipment (including software, or any hardware), or any other expenses incurred for the classroom.

Tax deductions as an online esl teacher. Tax deductions for teachers can really make a difference to your tax return so make sure you keep all your receipts and expense records. 2 hours agoaccording to the canada revenue agency (cra), the federal tax rates will be 15% and 20% for the first $49,020 of taxable income in 2022.

Many of your everyday expenses are tax. Canadian tax benefit for teachers. Educators can claim a refundable credit for up to $1,000 in eligible supplies they have purchased.

Online teaching is new and flexible way to make money on your own schedule! This means that spending money on the following items might be considered tax deductible as these expenditures are both ‘ordinary’ and ‘necessary’ for teachers: Some of you may be aware of the eligible educator school supply tax credit which allows you to write off up to 15% of $1,000 of eligible teaching supplies expenses as a qualified teacher.

31, 2020, and has not been renewed for 2021. Claim amounts for pension and savings income, contributions to cpp, qpp, and rrsps. Your expenses might be different than if you were in your home country, so be sure to be diligent about keeping track of all expenses on a spreadsheet along with receipts so.

Teachers in canada, often, have to fund their classroom supplies. Here are some expenses that you may be able to claim, include: Enter the result of the calculation on line 46900 of your return.

Pension and savings plans deductions and credits. The lifetime learning credit is for 20% of education expenses up to $10,000, or a maximum credit of $2,000. The refundable portion is 15% of the total eligible fees.

Approximately 5% of the company’s 2021 adjusted gross income will be devoted. The deduction for teachers who pay for classroom. Two married teachers filing a joint return can take a deduction of up to $250 apiece, for a maximum of $500.

You�re an eligible educator if, for the tax year you�re a kindergarten through grade 12 teacher, instructor, counselor, principal or aide for at least 900 hours a school year in a school that provides elementary or secondary education as. 1 day agohelping business owners for over 15 years. You can find details on the government of canada’s page for eligible educator school supply tax credit.

Top tax deductions for yoga teachers. In addition, taxable income above $49,020 is subject to a tax of 5%, if the value exceeds $48,040, up to $98,040. Teachers can claim the educator expense deduction regardless of whether they take the standard deduction or itemize their tax deductions.

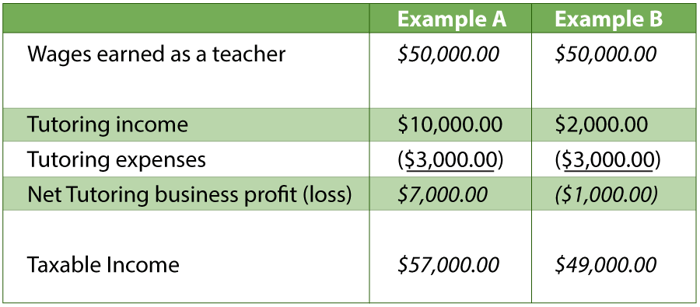

Next, it discusses the differences in personal and business deductions and it tells you which area you can take more deductions. Completing your tax return enter, on line 46800 of your return, the total of the expenses for the eligible educator school supply tax credit. Teaching resources or materials that were not paid for or reimbursed by your school

In 2016, the government of canada introduced a new refundable tax credit, the ‘eligible educator school supply tax credit’, that teachers could claim on their 2016 tax return and beyond. The education program wants this done before graduation although some won�t do it and new york state requires a teacher to have their certifications. If you have paid annual union, professional or like dues (e.g.

Teacher union dues, union membership dues) related to your employment, you can claim it on tax return by entering the amount from your t4 slip or under “other deductions” in deduction tab for dues not reported on t4 slip. Online teachers, specifically those who are independent contractors working for companies in other countries, are often left out of tax prep programs, but not here at keeper. You might be liable to pay taxes in the country you are living in.

My daughter has paid for several certification tests in 2020. The medical expense deduction is a deduction for medical expenses. Taxpayers whose medical expenses exceed seven percent qualify for the deduction for tax returns filed in 2022.

D’arrigo said teachers can deduct up to $250 for school supplies on their taxes, but billionaires can write off the entire cost of a private jet. If you are an eligible educator you may deduct up to $250 per tax filer for qualifying unreimbursed teaching expenses, such as: If you are an eligible educator in canada, you can now claim this 15% refundable.

The eligible educator school supply tax credit is a refundable credit that teachers and early childhood educators may claim if they have out of pocket expenses for teaching supplies. 26% and above is taxable as $151,978. It reviews the process of completing the schedule c and then the 1040.

Professional dues can not be carried forward. 12 tax write offs for online teachers 👩🏫. An eligible educator can deduct up to $250 of any unreimbursed business expenses for classroom materials, such as books, supplies, computers including related software and services or other equipment that the eligible educator uses in the classroom.

Purchasing mats, straps and other yoga accessories yoga liability insurance yoga marketing expenses, such as your email provider and website maintenance costs The deduction was up to $4,000 above the line, but barring new legislation, it is no longer available. Supplies for courses on health and physical education qualify only if.

A teacher can deduct a maximum of $250.