Taxpayers who don’t itemize can take a special $300 charitable contribution deduction on 2020 tax returns. This become law for 2008 and 2009.]

The majority of people choose standard deductions to avoid a lot of calculations and pay a fixed amount set by the internal revenue service (irs).

Tax deductions for those who don t itemize. The majority of people choose standard deductions to avoid a lot of calculations and pay a fixed amount set by the internal revenue service (irs). There are mainly two types of tax deductions that a taxpayer is free to choose from itemized or standard deductions. To claim the deduction, you need to complete two tax forms:

What is an itemized deduction? The new benefits allow taxpayers who do not itemize to take advantage of donations to charity—at least for a while. Those filing jointly should pay $10.00 for tax.

Single taxpayers get a $500 deduction. A simple breakdown is to equate $2,500 to $1700. Married taxpayers filing a joint return get $1,000.

A special tax provision will allow more americans to easily deduct up to $600 in donations to qualifying charities on their 2021 federal income tax return. As you can read above, the standard deduction for single taxpayers and married individuals filing separately has increased from $6,350 in 2017 to $12,950 in 2022. Washington — the internal revenue service today explained how expanded tax benefits can help both individuals and businesses give to charity before the end of this year.

The change was part of last december’s taxpayer certainty and disaster tax relief act of 2020, which. These include higher elective limits for charitable cash contribution made by certain corporations, higher deduction limits for. You do not need to itemize to claim the tuition and fees deduction.

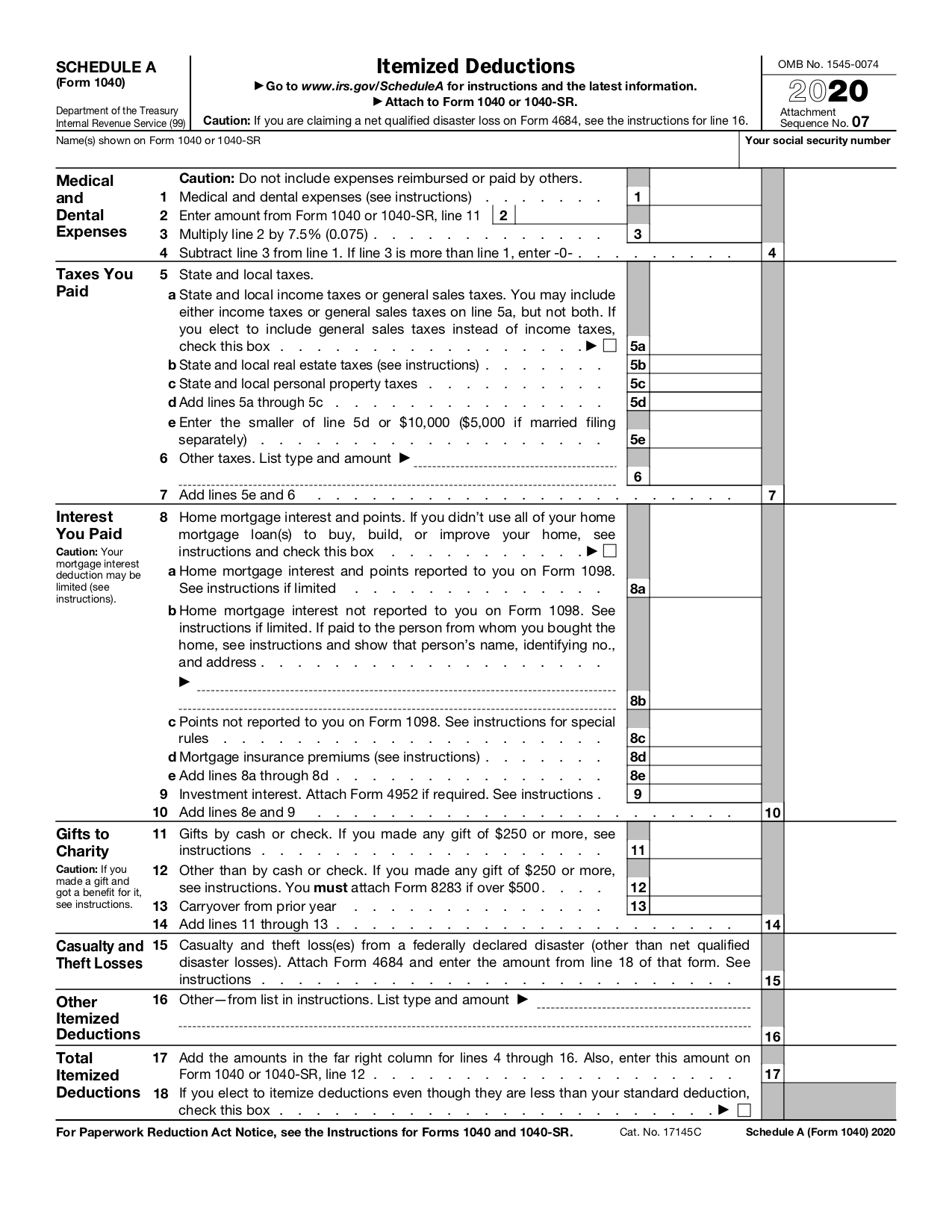

To get the most lucrative tax deductions, you need to itemize expenses using a schedule a. This form lets you write off mortgage interest, real estate taxes, charitable contributions and some. Schedule 1 and form 8917, tuition and fees deduction.

Lawmakers in both parties called thursday for restoring the charitable deduction for donors who don’t itemize their taxes. The ctc is fully refundable and there is no earned income requirement. Individuals who do not itemize can claim a deduction of up to $300 for cash contributions made to qualified charities during 2021, while married individuals filing joint returns can claim up to $600.

Recent changes in the tax regulations to help ease the burdens of the pandemic could lead to lower tax bills at filing time for some americans. They pay less by claiming the standard deduction of $5,700 for a single, $8,400 for a head of household or $11,400 for a married couple filing jointly, with. Among the various provisions is a federal income tax deduction for property tax paid by taxpayers who don’t itemize deductions.

Ron wyden, a democrat from oregon, who said there would be bipartisan support for renewing and expanding the deduction. Each taxpayer can deduct up to $300 for the 2021 tax year the cares act included a. Bigger tax breaks for itemizers.

Expanded tax benefits help individuals and businesses give to charity during 2021; The standard deduction for 2021 is $12,550 for individuals and $25,100 for married people filing jointly, up from $12,400 and $24,800, respectively, in 2020. This become law for 2008 and 2009.]

State and local income taxes or state and local sales taxes Taxpayers who don’t itemize can take a special $300 charitable contribution deduction on 2020 tax returns. However, for 2021, individuals who do not itemize their deductions may deduct up to $300 ($600 for married individuals filing joint returns) from gross income for their qualified cash charitable contributions to public charities, private operating foundations, and federal, state, and local governments.

“the charitable deduction is a lifeline, not a loophole,” said sen. #1 new deduction for people who don�t itemize individuals who elect to take the standard deduction generally cannot claim a deduction for their charitable contributions. Itemized deductions, on the other hand, can significantly reduce your.

You can only claim the deduction if your gross income is $80,000 or less for single filers and $160,000 or less for joint filers. It went from $12,700 in 2017 to $25,900 in 2022 for married couples filing jointly, and gone from $9,350 in 2017 to $19,400 in 2022 for heads of households. Special deduction for those who don’t itemize.

However, the cares act permits these individuals to claim a limited deduction on their 2020 federal income tax returns for cash contributions made to certain qualifying. Deduction for state, foreign income, local income (or sales taxes in lieu of income taxes), and property taxes is limited to $10,000 ($5,000 if married filing separately) per return. Gifts to individuals are not deductible.

The coronavirus aid, relief and economic security (cares) act includes several temporary provisions designed to help charities. A standard deduction is defined in alabama as a deduction, offered by default among taxpayers who don’t file itemized deductions. 21 hours agofor the 2021 tax year, there is a way for taxpayers who don�t itemize to benefit from charitable tax deductions.

While the tax breaks up to $300 or $600 are a perk for many filers, those who itemize deductions may.