Ad turbotax® makes it easy to get your taxes done right. Legitimate ato tax deductions for nurses only include expenses you’ve paid for yourself where you haven’t received a reimbursement.

Travel nurse reimbursements are stipend payments made to travel nurses to help pay expenses while they travel.

Tax deductions for travel nurses. 2020 tax guide for travel nurses 7 up to $75,000 $1200 to single individuals with an adjusted gross income of up to $75,000 annually up to $112,500 $1200 to heads of household with an adjusted gross income of up to $112,500 annually up to $150,000 $2400 to married couples with an adjusted gross income of up to $150,000 annually $500 Travel nurse reimbursements are stipend payments made to travel nurses to help pay expenses while they travel. If your employer has reimbursed you for costs, you can’t claim the expense as a tax deduction.

Lodging, meals, car rental, airfare, and parking fees and tolls are all deductible while working and in transit to and from your next work site. With the recent tax reform, many are considering the option of changing over to a 1099 employee.but, what’s the difference between w2 and 1099 for travel nurses? We reached out to nomad tax to help us answer this question.

What travel nurse tax deductions should i be aware of? To start your travel assignment, you have to get there. Legitimate ato tax deductions for nurses only include expenses you’ve paid for yourself where you haven’t received a reimbursement.

Travel nurses can also claim tax deductions for legitimate business expenses in excess of reimbursements or allowances. You can only claim a mileage deduction if you�re not reimbursed for it, and you can�t claim a deduction for miles you drive to and from work. However, a 50 percent limit applies to deductions for business meals and entertainment.

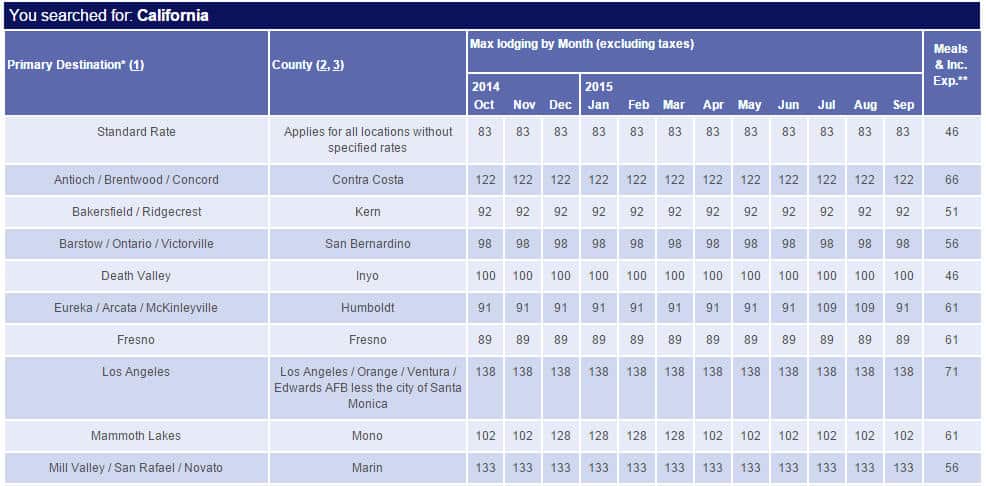

This deduction is limited to the regular federal per diem rate (for lodging, meals, and incidental expenses) and the standard mileage rate (for car expenses) plus any parking fees, ferry fees, and tolls. This is the residence you return to between jobs, as long as. Your tax home is your fixed abode.

As part of your traveling nurse pay, you�ll either be given a stipend for meals and incidentals or told to cover your meals and incidentals out of your salary. Most travel nurses operate as w2 employees. The expenses you have for driving.

Furthermore, if you work in home care health, as a contractor, or from home, you should try and see if you can get paid as a 1099 employee. Answer simple questions about your life and we do the rest. Every individual’s financial situation is different, and this article is not meant to substitute for professional tax advice.

To avoid being taxed on this money, you must meet the requirements that prove to the irs that you have a tax home. if you can�t, you will be taxed on the stipend payments. That’s why i’ve provided this list of tax deductions/breaks that you may qualify for as a traveling nurse. These are outlined in the sections below.

Ad turbotax® makes it easy to get your taxes done right. If you are a travel nurse, be sure to keep receipts of everything you pay for as you travel, such as mileage, rent, and meals. These include expenses for transportation, lodging, and meals.

Before claiming any deductions or otherwise acting upon the. This category will offer you the opportunity for more tax deductions. Per diems—distinguished from working on a per diem basis—are standard rates for lodging and meals.

Just for travel nurses if you work as a travel nurse, you may be qualified for special deductions due to the unique nature of your work life. If you were working as a staff nurse, you would typically be unable to write off housing, travel, or food expenses on your taxes. Your work outfit has to be specific to the work you do as a healthcare professional, pharmacist, or nurse.

Tax deductions are where you cover your bases for anything else.