This means local drivers can�t deduct food and. On the days they depart and arrive, they can only claim a partial day’s allowance instead of a full one.

Per diem for truck drivers.

Tax deductions for truck drivers per diem. Set up a free consultation with one of our experts. In lieu of per diem deductions, the standard deduction amount was doubled. If you have days outside the continental u.s., calculate them separately with the higher rate, and.

Simply speaking, the new tax code removed per diem deductions for employee truck drivers. Congress used a single line on page 4871 of the. Drivers who are subject to “hours of service” regulations can claim 80% of meals purchased on the road.

Per diem for truck drivers. Taxes and deductions that may be considered “ordinary and. Away from home considerably longer than an ordinary day’s work your work.

In its simplest terms, the per diem deduction is a tax deduction that the irs allows to substantiate ordinary and necessary business meal and incidental expenses paid or incurred. Truck drivers can either deduct 80% of their actual meal expenses or the per diem rate. The publication reads as follows:

You can only deduct meals while away from your tax home overnight, or at least long enough to require a stop to sleep or rest. According to irs publication 463, a truck driver must meet these criteria to be eligible for per diem tax deductions: The standard deduction for the 2020 tax year is:

Truck driver tax deductions may include any expenses that are ordinary and necessary to the business of being a truck driver. You can either keep all your meal receipts and claim your actual. This means local drivers can�t deduct food and.

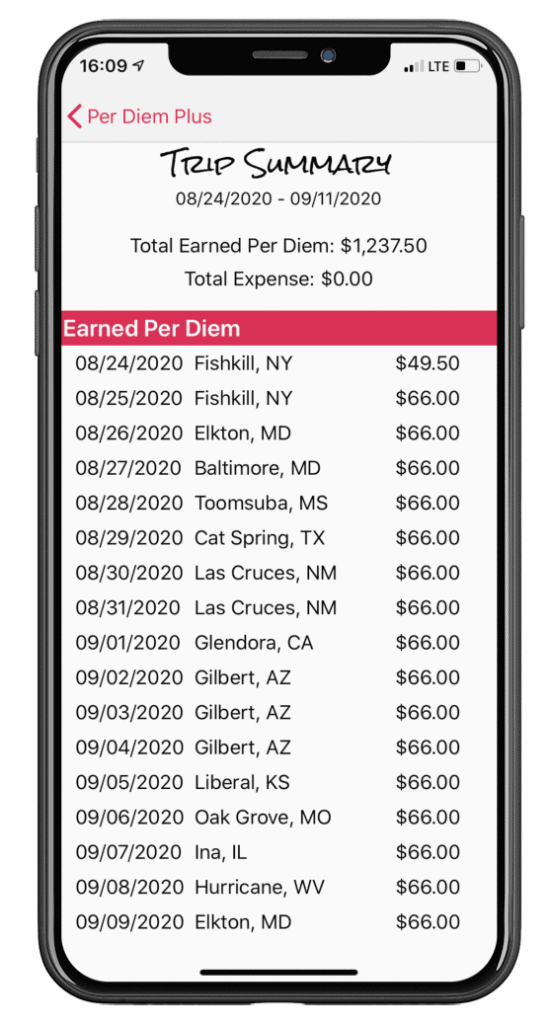

Use schedule c, profit / loss from. How much per diem can i deduct on my income tax return? For 2020, the special transportation industry per diem rate for conus (continental us) m&ie allowance is $66 and the oconus (outside continental us) rate is $71 as found in the irs.

He can either save all receipts for meals and incidental expenses and deduct %80 of those at. The per diem deduction for 2021 and 2022 represents a $3 increase for both items. According to publication 463 over the road truckers can claim $63 a day and instead of the 50% it is 80%.

Accounting services from $125 a month. Set up a free consultation with one of our experts. Accounting services from $125 a month.

(number of full days) x (per diem rate). Calculating your per diem tax deduction. As of january 2021, the per diem rate is $66 per day for travel within the continental u.s.

$12,400 for single taxpayers $12,400 for married taxpayers filing separately $18,650 for heads of households $24,800 for. On the days they depart and arrive, they can only claim a partial day’s allowance instead of a full one. If a truck driver fails to get per diem pay, he can do one of two things at tax time.