The american opportunity tax credit (aotc) is the major student tax credit available. This tax credit had been set to.

Equipment and other expenses associated with obtaining the education — ex:

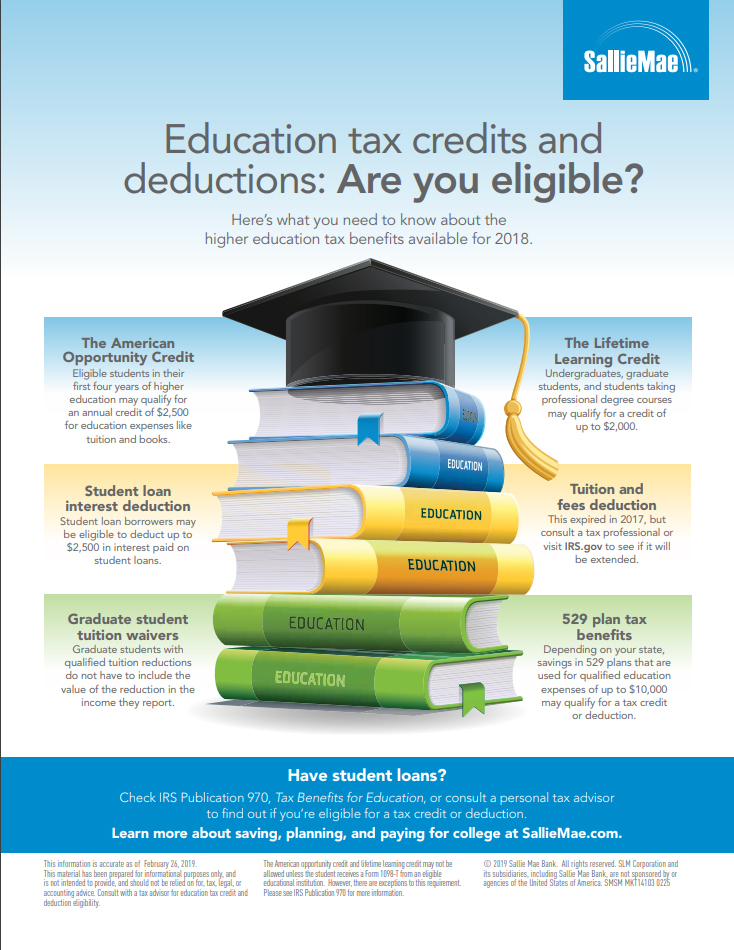

Tax deductions for tuition. Tuition and fees deduction those who paid education expenses (namely tuition) for themselves, their spouses, or their dependents can deduct up to $4,000. The lifetime learning credit is a tax credit for tuition and fee payments to a postsecondary educational institution, as well as other qualified expenses. If you pay $15,000 for tuition, your credit will equal $2,000 because of the $10,000 limit on qualifying educational expenses.

Information about form 8917, tuition and fees deduction, including recent updates, related forms and instructions on how to file. Your modified adjusted gross income (magi) must be less than $110,000 to qualify for the full $2,000 annual contribution as of tax year 2021. You can withdraw all of it, both contributions and accumulated interest, for tuition and other qualified expenses without paying any tax on the capital gains.

College tuition may be deductible for the 2021 tax year under the lifetime learning tax credit or the the american opportunity tax credit. The tuition and fees deduction was extended through the end of 2020. 12 hours agoyour tax deduction is limited to interest up to $2,500 or the amount of interest you actually pay, depending on whichever is less.

The elimination of this benefit emphasizes the value of a 529 college savings plan for deferring college costs. Primary/secondary school tuition the “529 deduction” also extends to tuition payments to elementary and secondary schools. Tax deductions for college expenses.

This tax credit had been set to. Tax deductions reduce your taxable income. The tuition and fee deduction was set to expire on december 31, 2020.

Tuition, books, supplies, lab fees, and similar items certain transportation and travel costs other educational expenses, such as. Usually, absence from work for one year or less is considered temporary. A deduction for tuition and fees can be taken for the 2020 tax year currently.

Filing married joint, magi less than $130,000 $2,000 deduction: Filing single, magi less than $65,000 $4,000 deduction: Equipment and other expenses associated with obtaining the education — ex:

You can use it to pay for courses at a college, university, or trade school. Taxpayers who paid eligible tuition and fees in 2018, 2019, or 2020 might claim up to $4,000 in deductions. You can�t always claim your education expenses as a business deduction.

The actual tax savings depends on your tax bracket. Is college tuition tax deductible? The credit is worth 20 percent of your.

You can deduct research and typing expenses you incur while writing a paper for a class. The lifetime learning credit is worth up to $2,000 per tax return. The american opportunity tax credit (aotc) is the major student tax credit available.

This is true even if the education maintains or improves skills currently required in your business. You can only claim the deduction if your gross income is $80,000 or less. It allows you to deduct up to $4,000 from your income for qualifying tuition expenses paid for you, your spouse, or your dependents.

Enter the lifetime learning credit. Tuition and fees education tax deduction. Form 8917 is used to figure and take the deduction for tuition and fees expenses paid in this tax year.

But there�s another tax break you might be able to claim. Tuition and fees deduction 2020 & 2019 $4,000 deduction: Expenses that you can deduct include:

Here are two tax deductions applicable to college expenses. This benefit can be extended by the white house if they wish, but would have to wait for that decision before implementation this benefit could be available for future tax years as it. For example, for a person in the 24% income tax bracket, a $1,000 tax deduction would lower their tax bill by approximately $240, or 24% of $1,000.

For now, it can only be implemented if congress votes to renew it in 2021 and 2020.