Make sure you understand which expenses can be deducted and track. Here are some tips to help you prepare your tax deductions for filing:

For 2019, that amount increases to $0.58 per mile.

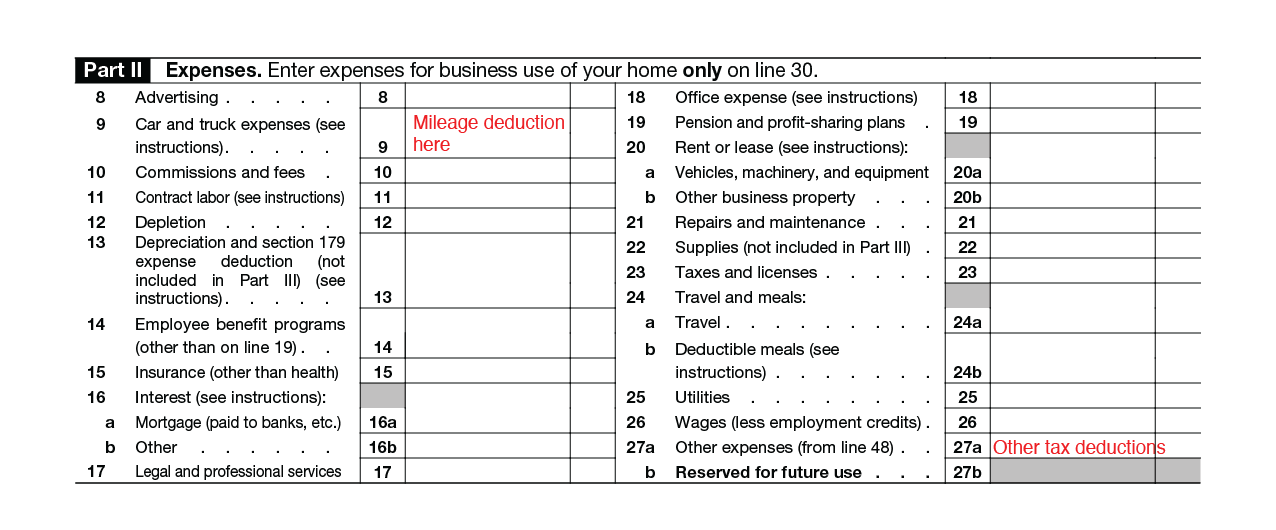

Tax deductions for uber drivers. Here are some tips to help you prepare your tax deductions for filing: Take the standard irs mileage deduction. Water, candies, gum and other items you provide.

Create a system to track your tax deductions. Delivery driver deductions like any business, there is a range of tax deductions you could claim as a delivery driver. If you are an uber driver, or a driver for any other rideshare company such as lyft, you are considered an independent contractor, not.

Some common deductions that uber and lyft drivers may claim: Many uber drivers end up buying a new phone that is only used for their business. This includes miles spent waiting for a trip, on your way to pick up a rider or an order placed via uber eats, and on a trip.

You can deduct the actual expenses of operating the vehicle, including gasoline, oil, insurance, car registration, repairs,. For 2019, that amount increases to $0.58 per mile. The uber and lyft apps.

All deductions can be made in addition to standard mileage and actual expense deductions unless explicitly stated. As an uber driver, you incur many expenses, and most of them are deductible. To claim the deduction as a rideshare driver, your taxable income can’t be more than $157,500, or $315,000 if you’re married and filing jointly.

The line for the qbi deduction is. Bottom line in addition to the items listed above, you might. Qbi deduction, which allows you to.

For the 2018 tax year, you may write off $0.545 for every mile you drove as an uber or lyft driver. Some common expenses that qualify as uber tax deductions include: Make sure you understand which expenses can be deducted and track.

100% deductible if you use it just for business, otherwise you can deduct the business use. Generally speaking, you may be eligible to claim: Then, this business phone’s costs are deductible.

The cost of your cell phone. What expenses are tax deductible for uber drivers? Tax deduction tips for uber drivers & rideshare drivers.

As of 2021, the rate is 56 cents per mile driven for business use.