Department of labor has a set of six criteria regarding what constitutes a legal unpaid internship. Your rights and the law.

That is not necessarily true.

Tax deductions for unpaid internships. That is not necessarily true. Internships, work placements, training, etc. But some people fail to pay;

This would be the case if you transfer the internship fee directly to the school or institution involved, which then uses the money for general training purposes. The test for unpaid interns and students courts have used the “primary beneficiary test” to determine whether an intern or student is, in fact, an employee under the flsa. Some observers are predicting that unpaid internships may increase now that the u.s.

As a paid intern, you are an employee of the company and therefore subject to all of its policies and procedures; Interns deserve to be paid and not doing so is exploitative and unethical. The unpaid interns are more likely to be viewed as students or visitors from the college and.

The “internship tax credit program,” would reward up to $2,000 in tax credits for each intern an employer hires. If you�re interning at a business that�s providing you with income (and in that case, congrats) then those are taxable wages just. There are very many different kinds of internship available.

On top of that, even employees cannot deduct miles to and from the workplace or other unreimbursed expenses. Internship tax credit program passes senate committee. Your rights and the law.

This means that in order to claim a deduction your expenses are first limited to 2% of your agi (so in order to deduct you must go above and beyond this amount). How to write off unpaid invoices in a sole proprietorship. Department of labor has a set of six criteria regarding what constitutes a legal unpaid internship.

In this part of the website, we treat interns who are providing services on a voluntary basis separately from those who are being paid. An unpaid internship must pass the A client of mine recently moved for a few months to work on an unpaid internship, and she has to pay to live while doing this intern.

While many internships are unpaid, they still provide plenty of value. Businesses could get an extra incentive to hire more interns through a proposal being heard in florida’s legislature. Any part of the stipend not used for such expenses is income that you have to report on your tax return and is taxed as wages.

June 6, 2019 8:09 am. Department of labor (dol) has relaxed its intern compensation standards, but there are many questions for. This means deducting taxes from your paycheck and paying employer payroll taxes, including unemployment taxes.

4 hours agointernships are often stepping stones into a college student’s future career. Yes you can deduct the fees you had to pay for your temporary housing while you were working the internship. Depending on how you were paid for the internship will determine how you deduct the expenses.

While they are a great tool, the problem arises when interns are not compensated for their time and work. Your employer must treat you as a regular employee for tax purposes. You will need to look at the agreement you have with the provider of the internship to see what your status is.

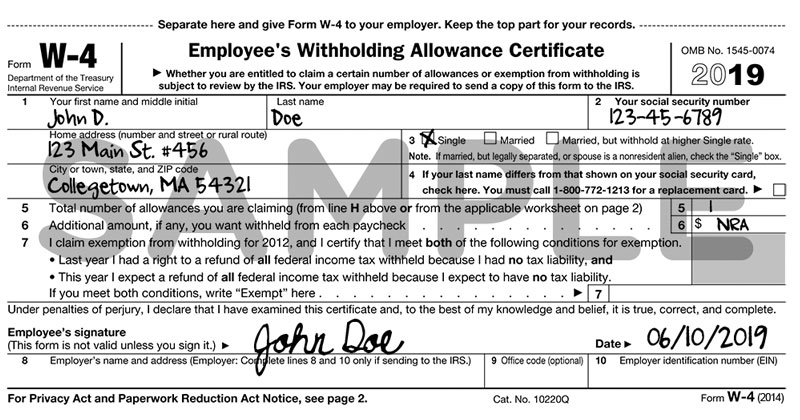

You may be employed or be a volunteer, undertaking unpaid work. First, an internship should not serve the purpose of providing you with a paycheck. Employers use it to determine the amount of tax that will be withheld from your paycheck, but for you it means that you’ll be added to the payroll.

You should check this with the irs or a cpa who is qualified to offer advice, but that is what i was told. They might go out of business, declare bankruptcy or leave town, making collecting the debt almost impossible. The tax credits would only be awarded if businesses meet conditions.

Ad turbotax® makes it easy to get your taxes done right. Employers who treat unpaid interns as free labor may be opening themselves up to a costly lawsuit. You cannot deduct expenses in connection with unpaid work.

Also, this would mean that you would be itemizing your deductions so you would be giving up your standard deduction of $5700 (if you are filing as single). Australia has a rigid set of rules about how unpaid internships and unpaid work can be conducted in a workplace. Of unpaid internships has risen in recent years and the job market for new graduates continues to worsen.

Answer simple questions about your life and we do the rest. If the intern does not receive the internship fee themselves, under certain conditions you are exempted from deducting and paying payroll taxes. In most cases, the internal revenue service (irs) counts unpaid interns as volunteers as opposed to employees.