@bidnit what is your question? The costs of any licenses you purchase are deductible from your federal taxes.

No longer can employees take deductions for these unreimbursed expenses, so if you�re responsible for paying for what you need, you have to do so without the hopes of writing these expenses off as a waitress on your tax return.

Tax deductions for waitresses. You also can deduct any fees you pay to do your work. There are no longer any work deductions available for employees in the food services industry. The cost of making up cash for till or bar shortages.

Income made in tips can be confusing as you try to determine how it factors in at tax time, and what you have to report to the irs. Examples of deductions from wages that are generally allowed under oregon wage and hour law are: I’m talking voided checks or or ones worth pennies.

The costs of any licenses you purchase are deductible from your federal taxes. For tax filings prior to 2018, as an employee, you can deduct the cost of a uniform, if you have to purchase it yourself. Waiters & waitresses tax deductions adequate tip records are a must for employees who receive tips, especially waiters and waitresses who work in “large food and beverage establishments” (i.e., food service operations with 10 or more tipped employees).

Many waitresses earn the majority of their their income from tips. Tax deductions for waiters greeting customers and presenting them with menus and drinks lists. The cost of renewing your special employees license (gaming license).

Taxes, garnishments, other deductions for the employee’s benefit which were authorized in writing by the employee. Some employers, for example, require independent servers to share a portion of their tips, and you can deduct these expenses. Tax deductions for hospitality workers:

Oregon wage and hour deduction law limit what can be deducted from the wages of waiters and waitresses. •services performed by someone who is not an employee, including parts and. These establishments often assign tips to employees, based

For example, if you had $1,000 of unreimbursed employee expenses in 2017 and your adjusted gross income is $30,000, you can only claim $400 of the expenses as a deduction. Tax deductions for food service workers tips are a big portion of income for those who work in the food industry, including waiters/waitresses, bartenders, busboys, hosts/hostesses, and sommeliers. Serving food and drinks and clearing tables.

Recommending wines, opening bottles and pouring drinks. Getting answers to your tax questions. I need to deduct tip outs paid to bussers, bartenders, and food runners paid each time i worked.

You cannot claim the initial cost. The thing is, bartenders and servers rely almost solely on their tips, often all of which are received in cash. No longer can employees take deductions for these unreimbursed expenses, so if you�re responsible for paying for what you need, you have to do so without the hopes of writing these expenses off as a waitress on your tax return.

Take a look below at our guide on tax deductions for bar and wait staff, waiters, waitresses, baristas, venue managers and other hospitality workers. The sales tax deduction calculator (irs.gov/salestax) figures the amount you can claim if you itemize deductions on schedule a (form 1040). You need to declare money you receive from salary and wages, investments or government payments.

A food or beverage service employee may be a bartender, cook, kitchen helper, waitress/waiter, busboy, maitre d�, hostess, dining room captain or wine steward. We cover the different areas you might be eligible to claim to make sure we get you the biggest and best tax return possible this year. Most deductions you can claim directly relate to earning your employment income (salary.

You can and can�t claim as a work. In the end, reed didn�t have to attempt the deduction for the hooter�s waitress. Income and allowances to report.

Im a server in a restuarant. Tax deductions for waiters and waitresses internal revenue service: I do not see it in this thread and could not find you in a search.

Taking orders and relaying them to kitchen and bar staff. @bidnit what is your question? Wise up on your wage summit accounting group:

If you earn your income as a hospitality industry employee, this information will help you to work out what: Waiters and waitresses tax deductions protax consulting services: You may be able to claim a deduction for some costs you incur.

Whether you’re a waitress, event manager, barista or mixologist, hospitality is not an easy field to work in. Report only the unreimbursed employee expenses to the extent that they exceed 2 percent of your adjusted gross income. Claiming tips on your tax return you may receive additional income in the form of tips.

So, to help all those hospitality workers out. Dining establishments typically are regulated by local municipalities, and you might have to pay for a servers license. Our checks are then taxed and depending on how much of your tips your employer is claiming, they can amount to literally nothing.

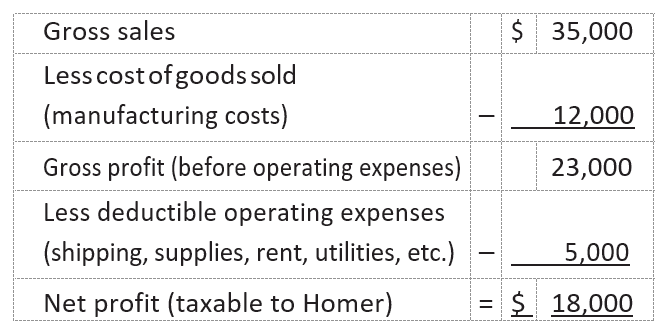

Deductions can reduce the income tax that you pay on the money you receive. There are a number of other, additional expenses that hospitality industry workers can claim as a tax deduction, including: