Tax reform in 2018 changed the home office deduction, including what traditional employees could deduct related to their work expenses. When using the regular method, deductions for a home office are based.

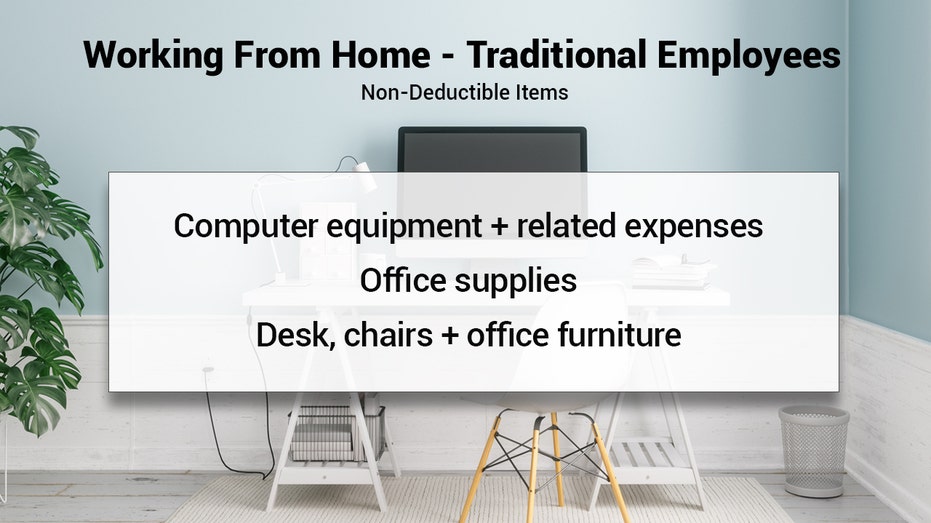

After tax reform became law at the end of 2017, employees lost the ability to deduct expenses related to maintaining a home office.

Tax deductions for work at home employees. The simplified option has a rate of $5 a square foot for business use of the home. Due to the tax cuts and jobs act of 2017 put in place by trump, home office expenses are no longer deductible for employees. Other work from home tax deductions performing artists.

Materials and equipment needed for the job. Expenses for working from home are not deductible for most employees since the 2017 tax reform law. As it stands now, the following employee or job related deductions cannot be applied with your 2021 return, but are scheduled to return beginning with 2026 returns.

One of the bigger tax deductions you can take if you work from home as an independent contractor is the home office deduction. For people filing for tax years before 2018 work from home deductions can be used. Also, the current limitation on deductions is set to expire in 2025, so after that tax year expenses for working from home will again be deductible for many employees.

In 2017, the bill was passed to lower both individual and corporate tax rates and, now, only a select group can take advantage of these itemized deductions at the federal level. The maximum deduction under this method is $1,500. To understand more about how you can claim tax deductions when working from home, take a look at the following tax tips for employees.

Tax deduction for employees� work at home expenses eliminated under tcja prior to the tax cuts and jobs act (tcja), which took effect in 2018, employees who worked at home for the convenience of their employer could get a tax deduction. This amount is a tax deduction and not a credit, which means you deduct it from your income to reduce your tax liability but will not result in a refund. Taxpayers who qualify may choose one of two methods to calculate their home office expense deduction:

For example, if your agi is $100,000 and your total miscellaneous deductions are $5,000, you can only deduct $3,000 — two percent of $100,000 is $2,000, and the amount over that is deductible. Although there are tax deductions in place for people working from home, they won’t apply to most remote employees during this pandemic. To take this deduction, you’ll need to figure out the percentage of your home used for business.

While congress has made some changes in tax law due to the coronavirus, home office deductions and other miscellaneous itemized deductions were not included in recent legislation. The $1,500 maximum for the simplified deduction. I have never claimed employment expenses before.

Before the tax cuts and jobs act (tcja) went into effect, remote employees were able to deduct all of the unreimbursed expenses that freelancers do. Say your home office occupies 10% of your house. The maximum size for this option is 300 square feet.

In addition, work from home expenses can only be deducted if they are greater than 2% of adjustable gross income. Gold flirts with $1900/oz ahead of. Tax deductions for work at home employees.

The employee claims the deduction as a miscellaneous itemized deduction on schedule a of form 1040. In short, the answer is no. When using the regular method, deductions for a home office are based.

After tax reform became law at the end of 2017, employees lost the ability to deduct expenses related to maintaining a home office. Many employees work from home because it�s convenient for their employer. Tax reform in 2018 changed the home office deduction, including what traditional employees could deduct related to their work expenses.

Before the tax cuts and jobs act (tcja) went into effect in 2018, you could deduct unreimbursed job expenses that exceeded 2 percent of your adjusted gross income (agi) on your federal income tax return using. Get smarter about your money and career with our weekly newsletter Previously, employees could claim an itemized deduction for.

In order to get a tax break, your miscellaneous deductions had to exceed 2% of your adjusted gross income and even then you were only allowed to deduct the amount over that 2% threshold.