Thanks to irs section 179 and bonus depreciation guidelines of the federal tax code, businesses (large or small) investing in new equipment may be eligible to deduct 100% of the purchase price of the equipment in 2021. In most cases you can claim tax relief on the full cost of substantial equipment, for example a computer, you have to buy to do your work.

If you buy a $2,500 computer and use it for work 40% of the time, you can write off $1,000!)

Tax deductions for work equipment. That�s because of the tax cuts and jobs act that passed in 2017. Tax deductions for nurses this is the exciting part. Did you go to b&h photo and purchase new lenses for that camera?

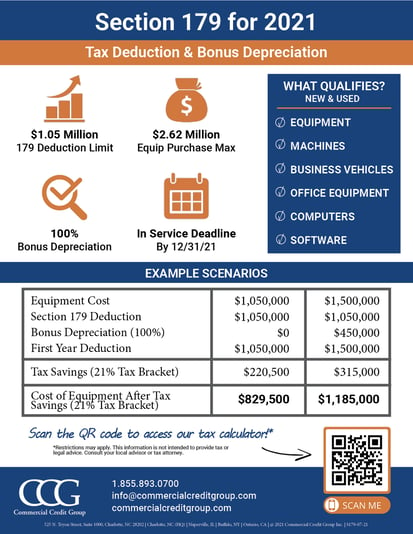

Irs section 179 allows qualifying equipment of up to $1,050,000 annually to be fully deducted. If you carry tools, instruments, or other items in your car to and from work, you can deduct only the additional cost of transporting the items, such as the rent of a trailer to carry them. Where there is a direct connection to your work duties, you can claim a deduction for equipment.

Thus, the entire deduction goes away after $3,670,000.00 in purchases. Examples of tools, equipment or assets. Perhaps you work as an employed officer but have a side gig in the field where you�re a 1099 worker.

You can only deduct $840 if your computer cost you $1,400 and you use it for business 60 percent of the time: For example, scrubs, lab coats, or medical shoes are items you can write off when doing your taxes. In 2021, the total you can write off is $1,050,000.00, but this section limits the total amount of equipment purchased to $2,620,000.00.

The section 179 tax deduction gets its name from section 179 of the irs tax code. This section of the tax code states that businesses may deduct up to the full purchase price of qualified business equipment from their taxes within the same tax year. 2021 tax deductions for new & used equipment purchases.

Film & video production equipment. The irs allows taxpayers to write off any piece of equipment that costs less than $2,500 in the first year using the de minimis safe harbor election. Work clothes are among the miscellaneous deductions that are only deductible to the extent the total exceeds 2 percent of your adjusted gross income.

Protective items, equipment and products, such as. Under section 179, you can expense the full cost of a tool the year you place it in service. You must also notify the irs on your tax return that you are taking this deduction.

The cost of furnishing and equipping your home office is one of the 2022 tax deductions for freelancers. Schedule 1 and form 8917, tuition and fees deduction. You can only claim the deduction if your gross income is $80,000 or less for single filers and $160,000 or less for joint filers.

That ends up being about a. Every piece of equipment that you purchase for your work is a deduction during tax season. Hand tools, such as spanners, hammers and screwdrivers or power tools, such as grinders, sanders and hammer drills.

The $1,500 maximum for the simplified deduction generally equates to about 35 cents on the dollar for most taxpayers, said markowitz. For example, if you provide your own flashlight for nightwork. If you buy a $2,500 computer and use it for work 40% of the time, you can write off $1,000!)

In most cases you can claim tax relief on the full cost of substantial equipment, for example a computer, you have to buy to do your work. You do not need to itemize to claim the tuition and fees deduction. These deductions could be useful for businesses that rely on the heavy use of a vehicle every day, such as a tractor truck that hauls.

If it is something you use at work but is not directly related to the job, such as a. Did you purchase a new camera this year? You probably know about some of the possible deductions listed below already, like educational costs and travel expenses, but the wide and varied field of nursing offers a plethora of options, credits, and deductibles that will help your finances in the coming season.

If so, then you could deduct various costs as they�d be considered business expenses.when you file your tax return, you�d fill out an extra form called schedule c where you can report expenses for travel, equipment, uniforms, cell phone service, insurance, fees and. So, if a freelancer spent thousands of dollars on equipment that permits them to do their job, they will be able to deduct that entire amount from the income that they made during the year as it was a necessary expenditure. You’ll only be able to deduct the cost of the equipment to the extent that you use it for business.

Expenses paid for lobbying activities cannot be deducted. If your business doesn�t have an applicable financial statement, you can take a business tax deduction for $2,500 per item, with an invoice, in the year you bought the equipment. You can also deduct the cost of laundry, meals, baggage, telephone expenses and tips while you are on business in a temporary setting.

Thanks to irs section 179 and bonus depreciation guidelines of the federal tax code, businesses (large or small) investing in new equipment may be eligible to deduct 100% of the purchase price of the equipment in 2021. Your work outfit has to be specific to the work you do as a healthcare professional, pharmacist, or nurse. To claim the deduction, you need to complete two tax forms:

This includes the cost of desks, chairs, lamps, computers and other office equipment. Equipment can range from heavy machinery like backhoes to computers and certain software programs for your business. Due to this, they are eligible to take deductions for any expenses that were connected to their work.