This includes new and used business property. Need a refresher on what’s deductible?

Top tax deductions for small business owners 1.

Top ten tax deductions for small business. Top 10 tax deductions for small business owners 1. Top 25 tax deductions for small business 1. Travel costs for obtaining employees,.

When you�re calculating your company�s expenses this tax season, don�t overlook these top 10 business deductions. Need a refresher on what’s deductible? Browse & get results instantly.

Top 10 small business tax deductions: Of the 23.4 million returns filed by sole proprietors for tax year 2011 (the latest year for which statistics are available), only 7.6 million. This includes new and used business property.

Findresultsnow can help you find multiples results within seconds. 10 commonly missed small business tax deductions under 10 minutes | the home bookkeeper thanks for watching. Starting a side business can give you serious financial advantages when it comes to taxes.

Then watching the video above on the top 10 tax deductions for small businesses should help. Here are the top 10 tax deductions deductions available to small businesses. Rent and utilities incurred at your principal place of business may be deducted.

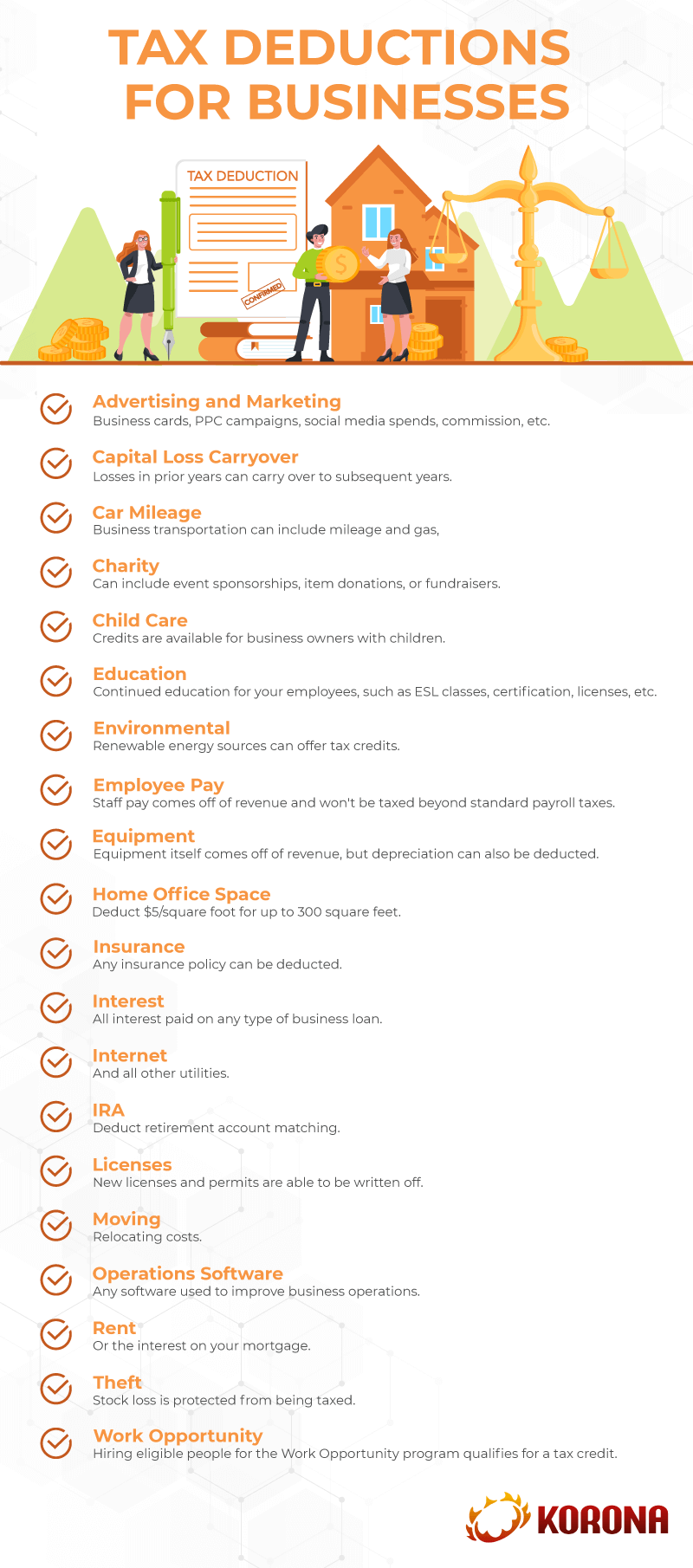

The section 179 deduction allows business owners to deduct up to $1,080,000 of property placed in service during the tax year. Expenses paid to power the business with internet and phone service can be written off to lower small business owners’ tax liability. If your business spends money on advertising and promotion, make sure you keep track of these expenses.

It’s tax deductible, in that case, and you may claim desks your. Many entrepreneurs don’t realize they can claim business expenses on a tax return for expenses that hit prior to the business’ launch. Don�t forget to like and subscribe.

Accommodation accommodation becomes a legitimate deductible. Furniture this past year, did you purchase furniture? Top tax deductions for small business owners 1.

The building you use for your company may not be yours but that doesn’t mean you can’t. As a small business, you can deduct 50 percent of food and drink purchases that qualify. Home office expenses if you’re a small business owner working from home, you may claim the costs of a home office.

Ad find out what tax credits you qualify for, and other tax savings opportunities. Get a personalized recommendation, tailored to your state and industry. Ad search for info about best tax deductions for small business.

Top 10 tax deductions for your small business 1. Hitting the road (or air) to either perform or find work is. If you started a business in 2015,.

You may have the opportunity to file a home office deduction for expenses related to your home office. You can use a side business to create a tax advantage for yourself.