The following can be eligible for a tax deduction: The standard deduction for the 2021 tax year is:

Consider residential renewable energy credits.

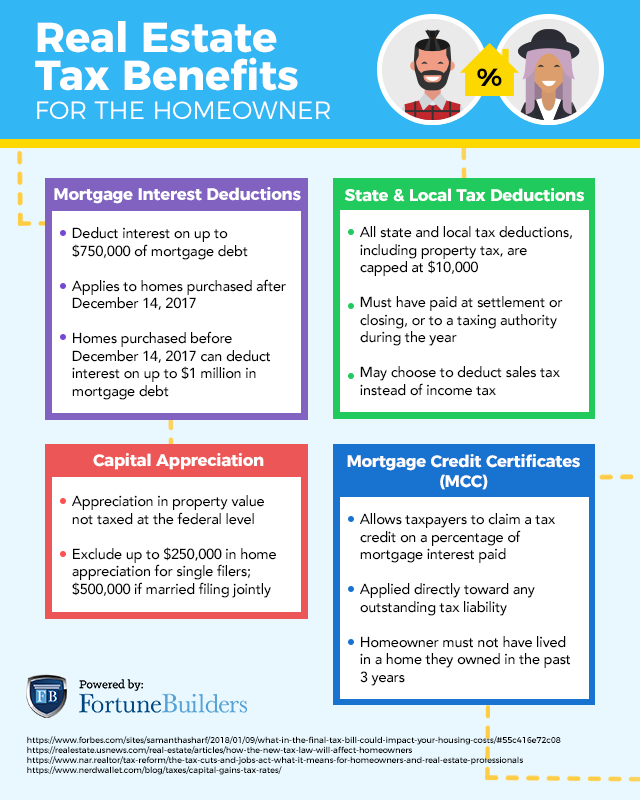

What are tax deductions for homeowners. The most significant tax deduction available for many people is based on the interest paid for their home mortgage. As a homeowner, you may be able to claim property taxes on your tax return this year. When you file your income tax return, you can make deductions, which are either standard or.

Deductions can reduce the amount of your income before you calculate the tax you owe. $25,100 for married couples filing jointly, up $300 from the 2020 tax year. When you own a home, the irs allows you to deduct some expenses on your annual tax return.

You meet the rules to deduct all of the mortgage interest and mortgage insurance premiums on your loan and all of the real estate taxes on your main home, then there is an optional method. You can deduct up to $10,000 of state and local income taxes, including property taxes. Credits can reduce the amount of tax you owe or increase your tax refund, and some.

Consider residential renewable energy credits. Homeowners can also claim a tax deduction for any loss in value of assets like appliances or furniture in the rental property or the part of the home that’s rented out. With many people looking for ways to lower their income tax, there are a.

$12,550 for single filers and married individuals. If your home equity loan�s interest is deductible, your. From 2018 through 2025, homeowners may deduct a maximum of $10,000 of their total payments for:

One of the tax deductions for homeowners takes effect when they itemize. Homeowners can deduct interest expenses on up to $750,000 of. The following can be eligible for a tax deduction:

These are taxes the seller had. These may include recordation and. If you’re a new owner who purchased a home in the past year, you can deduct the property taxes you paid at closing, along with other items.

Thereof what home improvements are tax deductible 2020? You can deduct home mortgage interest, property tax, loan points, or loan. Tax benefits of home ownership.

The mortgage tax deduction can be for interest paid on. Property tax, and state income tax or state and local sales tax. Don’t forget to include any taxes you may have reimbursed the seller for.

Be sure to retain the information. If you took out a home equity loan to consolidate bills or pay for college, for example, the interest is not deductible. The two big areas where homeownership can save a lot of money are:

For the 2020 tax year, the federal standard deduction is $24,800 if you’re married filing jointly, $12,400 if you’re single or married filing separately, and $18,650 if you’re filing as. The standard deduction for the 2021 tax year is: This is the biggest deduction available for homeowners.

Each mortgage payment includes an interest rate, which is where. Tips on tax deductions for homeowners.