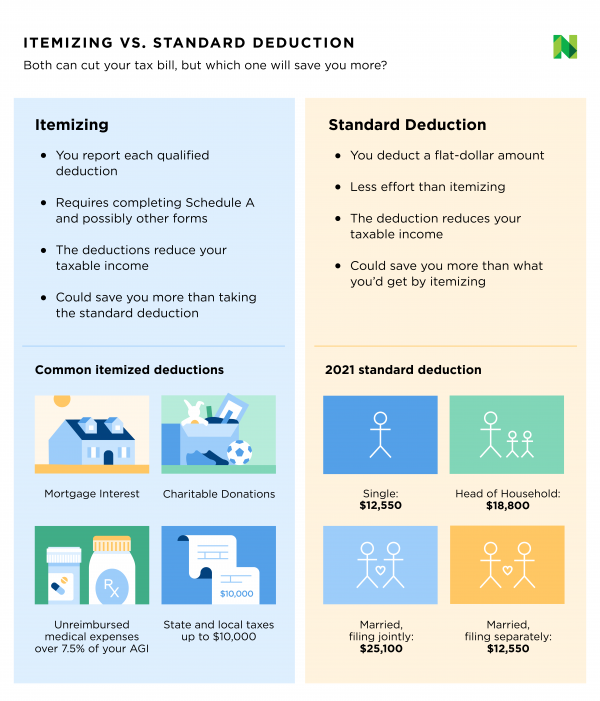

You can deduct medical, dental and vision premiums. For single and married individuals filing taxes separately, the standard deduction is $12,550.

For example, if your home office is 10% of your entire.

What can i get tax deductions for. You can claim up to $300 in charity deductions for the 2021 tax year—$600 for married people filing jointly. The limit is 7.5% of a taxpayer�s adjusted gross income (agi) for 2019 and 2020. In addition to health insurance premiums, you can write off expenses such as glasses, nonprescription medications,.

If you, a spouse, or your dependents had medical or dental expenses that exceeded 10% of your adjusted gross income, you can deduct them. If the home counts as a personal residence, you can generally deduct your mortgage interest on loans up to $750,000, as well as up to $10,000 in state and local taxes. In addition to mortgage interest, you can deduct origination fees and points used to purchase or.

You can deduct mortgage insurance premiums, mortgage interest, and real estate taxes that you paid during the year for your home. This deduction applies for single taxpayers with. Turbotax® makes it easy to find deductions to maximize your refund.

This limited deduction applies only to cash donations and non. You can deduct medical, dental and vision premiums. For married couples filing jointly, the standard deduction is $25,100.

Nonetheless, it can also include parking, car insurance, and maintenance fees. Credits can reduce the amount of tax you owe or increase your tax refund, and some. Get your share of more than $1 trillion in tax deductions.

Tax deductions do this by factoring in. In general, you can deduct qualified, unreimbursed medical expenses that are more than 7.5% of your adjusted gross income for the tax year. Know where you can save money and grow your profits 1.

You do this by lowering your taxable income. This means that only those expenses in excess of 7.5% of a taxpayer�s agi are deductible. Boost your refund with these 13 tax deductions and credits 1.

If you or your spouse are older than 65, you can. Understanding tax deductions is one of the best ways for you to lower your tax liability. The most recent numbers show that more than 45 million of us itemized deductions on our 1040s—claiming $1.2 trillion.

You can also deduct a portion of other expenses, including utilities, based on the size of your office versus your home. (how it works.) deduction for state. Ad we maximize your tax deductions & credits to ensure you get back every dollar you deserve.

To deduct prepaid mortgage interest (points) paid to the lender if you must meet. Generally, the credits tend to show better results, but the deduction may be used if it decreases your tax liability and/or increases your refund. The new child tax credit was made fully refundable in 2021 and increased to up to $3,600 per.

Ad we maximize your tax deductions & credits to ensure you get back every dollar you deserve. Turbotax® makes it easy to find deductions to maximize your refund. For single and married individuals filing taxes separately, the standard deduction is $12,550.

Simply multiply the monthly amount by 12 to get your annual total interest. The only tax deductions on a home purchase you may qualify for is the prepaid mortgage interest (points). For example, if your home office is 10% of your entire.

Deductions can reduce the amount of your income before you calculate the tax you owe.