Whether you paid for advertising on facebook, google ads, local tv spots,. The irs has a set of guidelines that differentiate an employee from a 1099 contractor.

Any cost that you spend on advertising for your business can be deducted from your 1099 tax form.

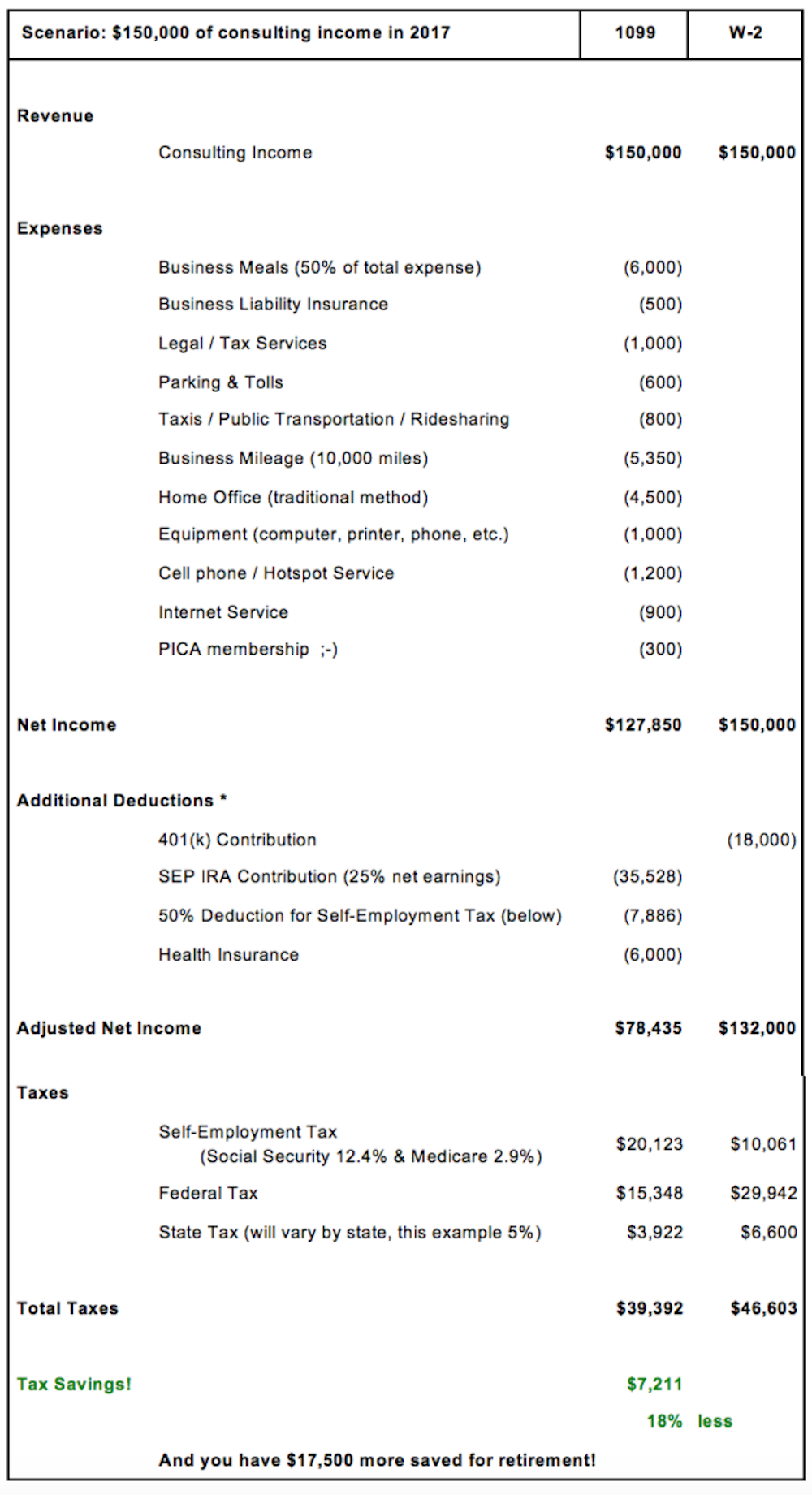

What is tax deductions for 1099 contractor. You must be aware of how much tax you need to pay on 1099 income. 100% of your health insurance is one of the many deductible business expenses for independent contractors to include on your 1099. As a 1099 worker, you cannot deduct many expenses related to owning a business, such as advertising or supplies.

If you work as an independent contractor, you can deduct the. You can deduct medical, dental and vision. One of the most popular 1099 independent contractor deductions we see is for mileage.

You can deduct these as a business expense, so your taxable income and tax brackets aren’t. The optional method requires no additional record keeping. Any cost that you spend on advertising for your business can be deducted from your 1099 tax form.

The deduction is $5 for every square foot of your home office, up to $1,500 per year. Here are the top 1099 tax deductions and some additional ones that you may have not known about! Unlike independent contractors, employees generally pay income tax and.

Independent contractors who use a portion of their home for work — and no other purpose — can deduct either $5 per square foot, up to 300 square feet,. Usa who work as independent contractors and receive 1099 forms from their. The irs has a set of guidelines that differentiate an employee from a 1099 contractor.

1099 deductions are personal income tax deductions available to certain us people. 1099 contractors have a lot more freedom than their w2 peers, and thanks to a 2017 corporate tax bill, they are allowed significant additional tax deductions from what is called a 20% pass. Snacks and coffee a little.

As you can see, the standard deduction only increased slightly last year. The 1099 form is the government tax form that we use to report all money we have paid to individual contractors (you). Whether you paid for advertising on facebook, google ads, local tv spots,.

If you hired a graphic designer to design a logo for you, or contracted with a. If you’re an independent contractor, chances are you drive a lot. For more information on estimated tax, refer to publication 505, tax withholding and estimated tax.

However, it’s still pretty hefty, so many 1099 contractors are opting for the standard deduction over.