Tax deductible expenses for photographers photographers: With a lower taxable income, you�ll end up paying less in taxes.

With a lower taxable income, you�ll end up paying less in taxes.

What is tax deductions for photographers. Creative and editing software write off any software you use for video and photo editing or content creation. Deductions for filmmakers and videographers. You’ll need to complete schedule 1 and form 2106 to claim this deduction.

Nonetheless, it can also include parking, car insurance, and maintenance fees. If you work in still or video photography, , some of the tax deductions you may be able to claim on your personal tax return are: What this means if that you�re able to write off 20% of that equipment per year.

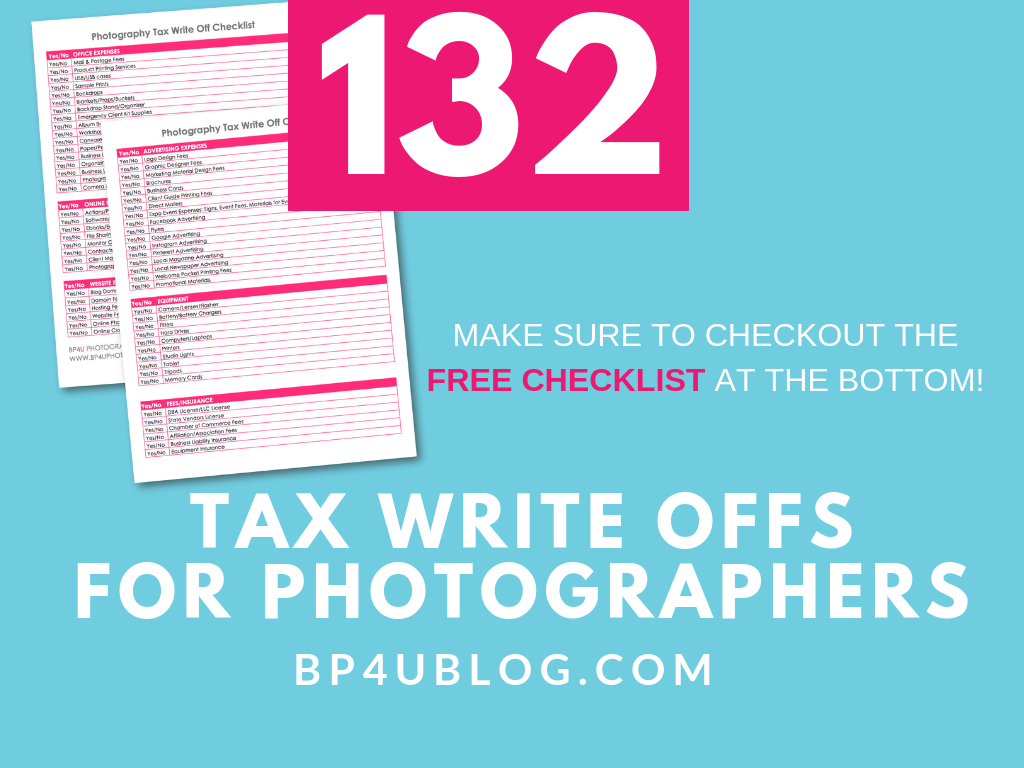

These deductions are subject to what is often called the “2 percent limit,” meaning that the expenses are not deductible if they total less than 2 percent of your adjusted gross income (agi). Ad answer simple questions about your life and we do the rest. This is a basic list of typical expenses incurred by photographers.

Use excel spreadsheet for bookkeeping or a software which will make your life easier once tax season comes. Credits can reduce the amount of tax you owe or increase your tax refund, and some credits may give you a refund even if you don�t owe any tax. Your office, studio, and gallery can all be tax deductions if they are solely used for your photography business.

Plus, you may be paying your own insurance premiums. Deductions can reduce the amount of your income before you calculate the tax you owe. Photographers can actually deduct gift expenses for their clients.

Deduction for cpp or qpp enhanced contributions on employment income. As we explore these possible tax deductions for filmmakers and videographers, keep in mind that you could end up audited. Just remember that the gift amount cannot exceed $25 per client.

Create a separate bank account for business only. When you claim federal tax credits and deductions on your tax return, you can change the amount of tax you owe. From simple to complex taxes, filing with turbotax® is easy.

Top professional photography gear is undoubtedly expensive. Photographers paying their own taxes will incur a higher amount of medicare and social security taxes than regular employees. Carrying charges, interest expenses, and other expenses.

Tax deductible expenses for photographers photographers: Allowable expenses for self employed photographers. 50% of the costs of meals and accommodations for the extra two days can be deducted, just like the first three days.

Simply deduct only the amount you personally pay. Can you consider yourself a “business”? If your business space is totally outside of your home, all rent and utilities are deductible business expenses.

But often you get what you pay for. This is true even if you use a shared location; But, for tax years prior to 2018, if you’re looking for a job in the same field, you itemize your deductions, and these expenses exceed 2% of your adjusted gross income, any qualifying expenses over that threshold can be deducted.

Potential tax deductions for photographers photography equipment = business expenses this is the most obvious tax deduction for photographers. Create a business plan dictating goals and profit margins, and file a schedule c form when you complete your taxes. Book, magazines, reference material business insurance business meals cabs, subways, buses equipment film developing/processing

Use this list to help organize your photographer tax preparation. As standard, lenses, camera bodies and other major photography equipment is depreciated over the course of 5 years. Meals and travel the cost of buying meals when you work overtime, provided you have been paid an allowance by your employer (you can claim for your meals without having to keep any receipts, provided you can show how you have calculated the.

Be sure that you can justify your deductions. What type of things can you “write off”? Itemize all expenses related to.

Tax season is upon us, and as a model, it can be very confusing when it comes time to file. Cameras, video camera, lenses, lighting, tripods, used for work are all tax deductible! Remember tax deductions for bloggers have to be items related to your business.

Read below for a basic overview on how to approach your taxes as a model! That point is going to come up a lot as we move forward. Here are some typical allowable expenses:

12 tax tips for bloggers and online influencers. Is a tax deductible expense! Now let’s look at some easy ways that deductions can save you some money.

Online advertising every dollar you spend on facebook ads, google adwords, etc. In the main anything you need to pay for in relation to working as a photographer will be allowable or “tax deductible”. With a lower taxable income, you�ll end up paying less in taxes.

To deduct the cost of photography props during tax season, conduct your work as a business with growth potential. Any expenses above and beyond that 2 percent limit are deductible.