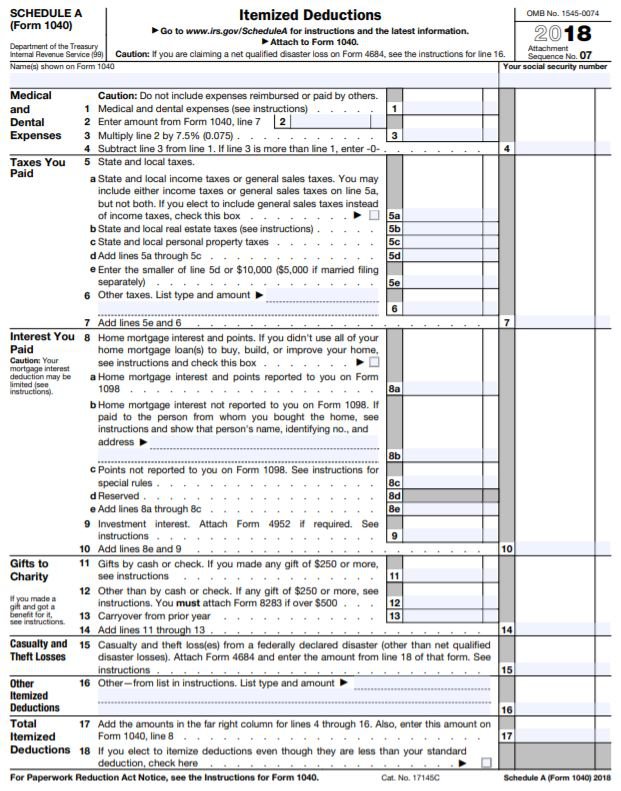

But the point of the statement is clear — more deductions equal fewer taxes. Interest paid on mortgages and stock margin accounts may be deducted, as can real estate tax and state and local income tax.

/property-tax-deduction-3192847_final-ca30dd2f9dcc4ce5b97d8a9e5615b3c7.png)

Fees, licenses, memberships, and insurance annual fees are a common cost of doing business and are deductible.

What is tax deductions for real estate. So if you paid $5,000 in state and local taxes and $10,000 in property taxes, you can deduct $5,000 of the property taxes. What is the maximum property tax deduction? Most real estate agent marketing expenses will fall under the category of a tax deduction.

When must an estate file a 1041? To maximize investment property tax deductions, it�s important to work with an accountant who is knowledgeable and experienced in real estate. Costs incurred to administer your final affairs are also deductible for estate tax purposes.

Casualty losses casualty and theft are cases when investment property tax deductions apply. Capitalize on the trust explosion! Most real estate investors purchase rental property for the monthly income, potential appreciation in property value over the long term, and the available tax deductions.in this article, we’ll take a quick look at how deductions on a rental property work, then review 30 rental property tax deductions, including a few that many investors overlook.

Property marketing online and newspaper ads, photography, staging, and signage are all tax deductible. The maximum deduction allowed for state, local and property taxes combined is $10,000. Other items include website development and maintenance,.

469 (a), (c) (2), and (c) (7)). Deduction #3 show detail legal & professional services real estate agents can deduct legal and professional fees to the extent they are an ordinary part of and necessary to operations. Here are the most common tax deductions taken by real estate pros:

In other words, you must be up to date on your taxes to qualify for the deduction. When buying real estate, there are a few tax deductions that apply. In real estate, that means your state license renewal, professional memberships, and mls dues.

Deduction #4 show detail advertising expense the irs allows you to deduct reasonable advertising expenses that are directly related to your business activities. Whether you will pay zero dollars in taxes is a different story. The standard deduction amount is based on your filing status, age, and whether you are.

Marketing tax deductions for real estate agents. Interest paid on mortgages and stock margin accounts may be deducted, as can real estate tax and state and local income tax. The single most claimed tax deduction for all small businesses is car and truck expenses.

These deductible expenses include accounting A tax deduction reduces your taxable income for the year, thereby lowering your tax bill. If a taxpayer qualifies as a real estate professional, however, the passive activity loss rules do not apply and losses from rental real estate activities are deductible against nonpassive income such as wages or schedule c income (secs.

So, let us take a look at the tax benefits that apply to rental properties: Property taxes are only deductible if your property was assessed by the local government and you paid all of your previous year’s property taxes. You can deduct the costs of certain materials, supplies, repairs, and maintenance that you make to your rental property to keep your property in good operating condition.

Under the new tax law, you can deduct up to $10,000 in property taxes for the current year. When preparing a decedent’s final income tax form 1040, or an estate or trust’s form 1041, you may deduct certain types of interest and taxes. Licences & fees your state license renewal, mls dues, and professional memberships, are deductible.

What taxes are deductible on form 1041? But the point of the statement is clear — more deductions equal fewer taxes. Fees, licenses, memberships, and insurance annual fees are a common cost of doing business and are deductible.

Whether it’s sales and open house signs and flyers or business cards, these types of marketing materials are all tax deductions for real estate agents. The reason is because of the many tax deductible expenses. Of course, these deductions also include owning the rental property.

Examples include funeral and cemetery charges and payments to officiating clergy. There are four types of expenses that qualify as estate tax deductions. Deductible real property taxes include any state or local taxes based on the value of the real property and levied for the general public welfare.

So if you were dutifully paying your property taxes up to the point when you sold your home, you can deduct the amount you paid in property taxes last year up to $10,000. Travel expenses are an important tax deduction for real estate investors, especially those out of state. If you invest remotely, traveling to.

You can deduct the expenses paid by the tenant if they are deductible rental expenses. In particular, we want to address some of the most frequently asked questions. The cost of all driving you do for your real estate business, with the important exception of commuting to and from your home to work, is tax deductible.

Deductible real property taxes don�t include taxes charged for local benefits and improvements that directly increase the value of the real property, such as assessments for sidewalks, water mains, sewer lines, parking lots, and.