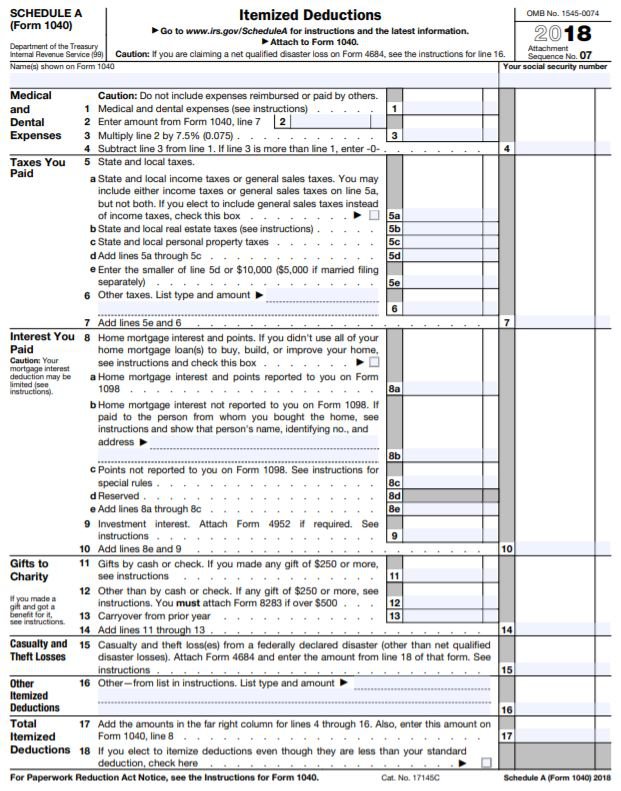

Itemizing if you itemize deductions, you may be able to deduct mortgage interest and. If you contribute $2,800 toward their lodging costs, for instance, you treat that as $1,400 each.

8 tax benefits of buying a home in 2021 | lendingtree there are several tax benefits of buying a home you should know about.

What tax deductions for buying a house. Mortgage interest deduction you can. New homeowner tax credits and deductions. Whether you are buying or selling a house, the process can be quite stressful, especially when thinking about potential tax implications.

Mortgage interest deduction before the tax cuts and jobs act, homeowners could deduct interest on up to $1 million in mortgage debt if married and filing jointly, or $500,000 if. Your main home secures your loan (your main home is the one you live in most of the. $12,550 for single filers and married individuals filing.

Most of the favorable tax treatment that comes from owning a home is in the form of deductions. For most people, the biggest tax break from owning a home comes from deducting mortgage interest. Of course, these deductions also include owning the rental property.

Don’t forget to include any taxes you may have reimbursed the seller for. Itemizing if you itemize deductions, you may be able to deduct mortgage interest and. 8 tax benefits of buying a home in 2021 | lendingtree there are several tax benefits of buying a home you should know about.

$25,100 for married couples filing jointly, up $300 from the 2020 tax year. The standard deduction for the 2021 tax year is: Two major incentives are the mortgage.

The only tax deductions on a home purchase you may qualify for is the prepaid mortgage interest (points). So, let us take a look at the tax benefits. Funds provided are less than points.

The irs sets the standard deduction amount yearly. Here are the most common deductions: You can deduct mortgage interest and property taxes.

For tax year prior to 2018, you can deduct interest on up to $1 million of. One of the most advantageous things about investing in rental properties is the deductions you can take at tax time. The way it works is if.

Just remember that under the 2018 tax code, new homeowners (and home sellers) can deduct the interest on up to only $750,000 of mortgage debt, though homeowners who got. If you contribute $2,800 toward their lodging costs, for instance, you treat that as $1,400 each. Points paid by the seller.

The standard deduction for single or married people filing separately was $12,400. Another home buying tax deduction is apportioned mortgage interest. Here’s a look at what is (and isn’t) deductible on your tax bill.

When buying real estate, there are a few tax deductions that apply. The first tax benefit you receive when you buy a home is the mortgage interest deduction, meaning you can deduct the interest you pay on your. Most people don’t realize that within certain limits, you can deduct your mortgage interest.

The state and local tax deduction, known as the salt deduction, lets you deduct the value of your state and local property tax payments, plus either your income or sales taxes. When you are buying a home, depending on when in the month the house is closed, the buyer pays either. For the 2020 tax year:

The following can be eligible for a tax deduction: Let’s look at the documents you need. These are taxes the seller had.