The following can be eligible for a tax deduction: This is less than the standard deduction ( $12,950 for single filers, $19,400 for heads of households, and $25,900 for couples filing jointly), so it may or may not work in your favor to take this one.

For mortgages that went into effect before 16, 2017, one can deduct interest on loans up to $1 million, ($500,000 if you are married filing separately)

What tax deductions for new homeowner. The second significant tax change to be aware of as a new home buyer is that the standard deduction has doubled. Each mortgage payment includes an interest. The trick here is what qualifies as “necessary.”

The mortgage tax deduction can be for interest paid on loans for no more than two. $12,550 for single filers and. If you’re a new owner who purchased a home in the past year, you can deduct the property taxes you paid at closing, along with other items.

What tax deductions do i qualify for? Let�s take a look at a few tax deductions you might be eligible for as a homeowner. For the 2020 tax year, the federal standard deduction is $24,800 if you’re married filing jointly, $12,400 if you’re single or married filing separately, and $18,650 if you’re filing as head of household.

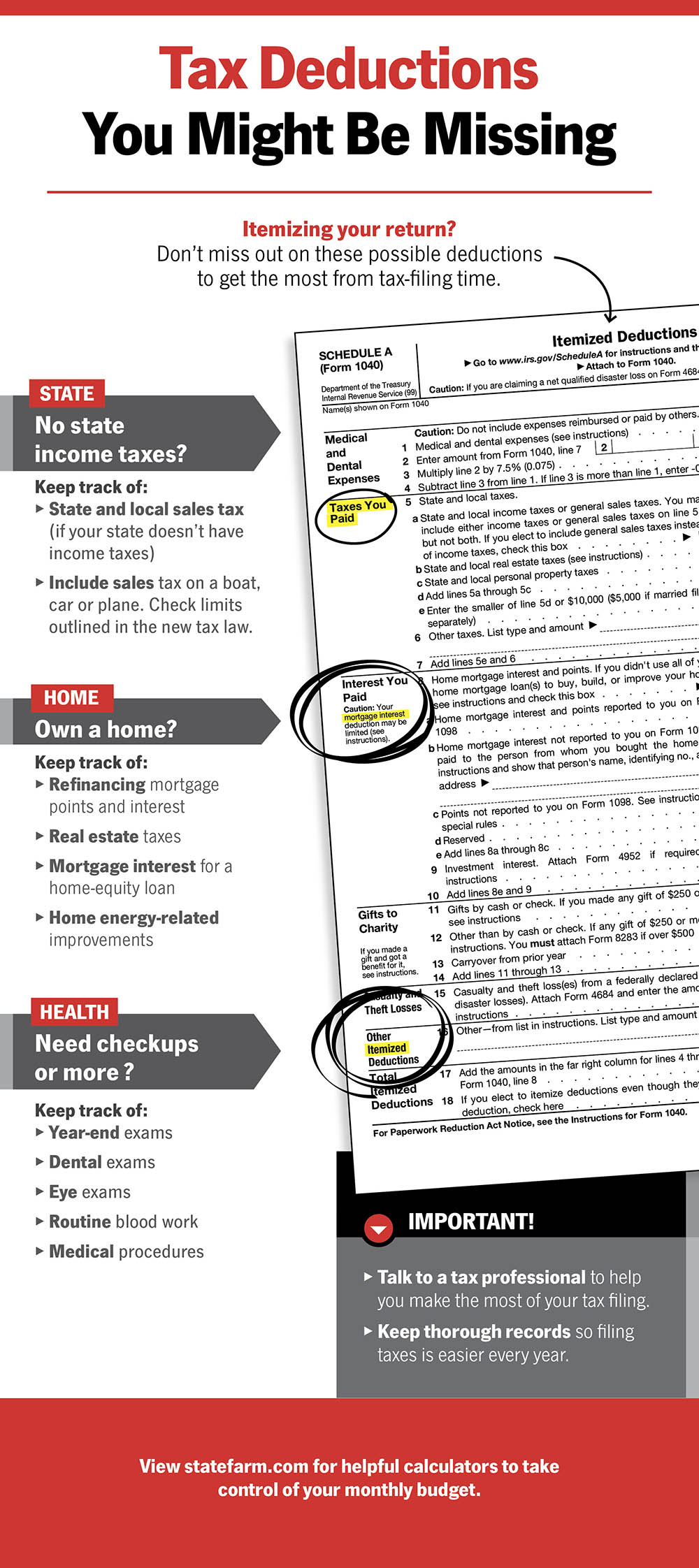

The mortgage interest on your primary residence, as well as on a second residence. State income tax or state and local sales tax. There is an optional method for determining your mortgage interest and state and local real property tax deduction if you received assistance from a state or an entity of a state that was funded from amounts from the homeowners assistance fund program in which a portion of the program payments is used to pay mortgage interest, mortgage insurance premiums or state.

As a homeowner, you may be able to claim property taxes on your tax return this year. Ad turbotax® makes it easy to get your taxes done right. There is speculation that this will have a significant impact on the value of homeownership.

Don’t forget to include any taxes you may have reimbursed the seller for. The standard deduction for the 2021 tax year is: If you’re filing jointly with your spouse, the maximum property tax deduction available is $10,000 per.

When it comes to tax breaks for homeowners, the same principle applies. As a married couple filing jointly, you can deduct up to $10,000 of your property taxes. You had to itemize your returns, and your taxes — as well as any other state and local tax (salt) deductions you’re taking — can’t exceed $10,000.

For mortgages that went into effect after 15, 2017, homeowners can only deduct interest on the first $750,000 ($375,000 if you are married filing separately) of your loan (s). If you are single or filing separately, you can deduct up to $5,000 in property taxes. You can either take a standard deduction or submit an itemized deduction.

8 tax breaks for homeowners mortgage interest. You can�t deduct certain home expenses, such as. These may include recordation and transfer fees, and any real estate taxes paid by your lender.

As a homeowner, though, you may have enough in eligible expenses to itemize your deductions. Homeowners can often deduct interest, property taxes, mortgage insurance, and more on taxes. (there are limits, but relatively few.

For mortgages that went into effect before 16, 2017, one can deduct interest on loans up to $1 million, ($500,000 if you are married filing separately) Tax deductions for homeowners mortgage interest. The majority of homeowners in around 20 states have been writing off more than $10,000 in salt each year, so they’ll lose some of this deduction.

Answer simple questions about your life and we do the rest. For individual filers, the amount is now $12,000, and it’s up to $24,000 for married couples. From 2018 through 2025, homeowners may deduct a maximum of $10,000 of their total payments for:

Read on to learn more about homeowner tax breaks, how to use them and whether they might be a way for you to lower your tax bill. This $10,000 limit applies to both single and married taxpayers and is not indexed for inflation. Essentially, taxpayers can handle tax deductions in 1 of 2 ways.

This is less than the standard deduction ( $12,950 for single filers, $19,400 for heads of households, and $25,900 for couples filing jointly), so it may or may not work in your favor to take this one. The following can be eligible for a tax deduction: You can deduct up to $10,000 of state and local income taxes, including property taxes paid on your primary home, or any other real estate you own.

If you’re married but filing separately, you can deduct up to $5,000. You can deduct the interest on your mortgage, but you�re limited to interest on $750,000 of mortgage debt if you purchased your home after december 15, 2017. This is the biggest deduction available for homeowners.

The home mortgage interest deduction (hmid) is one of the most cherished american tax breaks. As a homeowner, you pay property taxes at both a state and local level. Usually, a large chunk of your initial mortgage payments go toward paying interest on the loan, and only a.

$25,100 for married couples filing jointly, up $300 from the 2020 tax year. The most significant tax deduction available for many people is based on the interest paid for their home mortgage. If you take a standard deduction than there is less math involved for you.