(chances are that older homes have dehumidification, the typical owner response is to units. They must meet or exceed a 95% afue.

This results in a home that is cool, but efficiencies of some systems can be as high as seer “clammy.”.

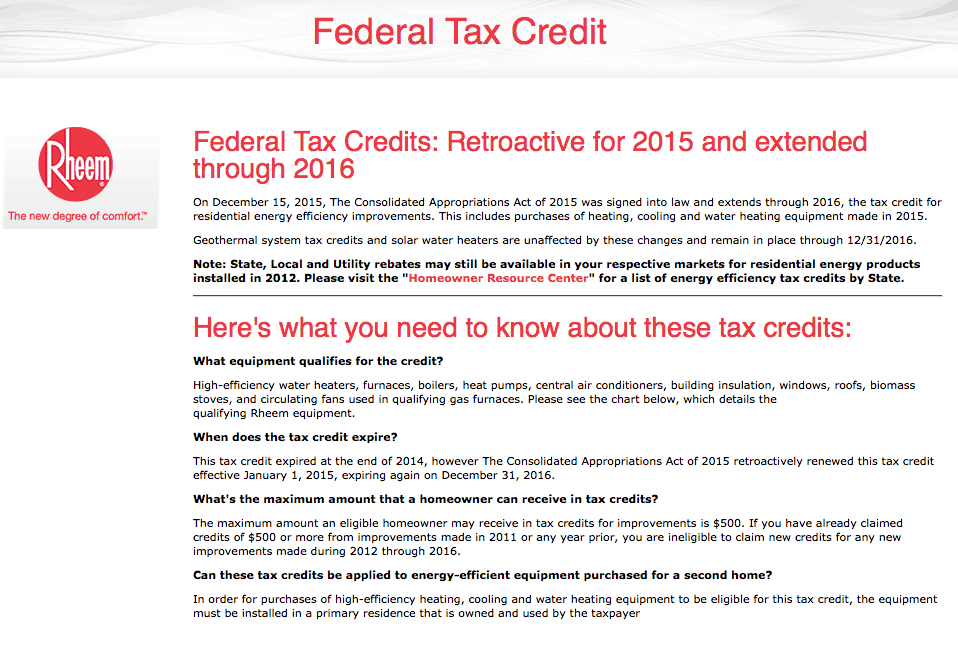

When energy efficient tax deductions for air conditioner. In addition, any furnaces using natural gas, oil, or propane can yield a $150 tax credit. $150 maximum credit available for qualifying furnaces and boilers. On top of that, indiana now offers the below rebates of up to $1,000 per household until the budgeted $6.1 million runs out.

You can claim a tax credit for 10% of the cost of qualified energy efficiency improvements and 100% of residential energy property costs. Even if your air conditioner is only 10 years old, you may save 20 to 40 percent of your cooling energy costs by replacing it with a newer, more efficient model. The irs does not allow you to file a 1040ez form or 1040a form if you also want to claim energy efficiency tax credits.

The residential energy property credit is nonrefundable. You can qualify for tax credit up to $150. The incentive is capped at $500.

The eer is the energy efficiency ratio, a number produced by dividing the air conditioner btu rating (its output) by its wattage (its input). This results in a home that is cool, but efficiencies of some systems can be as high as seer “clammy.”. There has been alot of publicity about the federal tax credits up to $1500 for high efficiency heating and air conditioning units.

19 reviews of ac kings energy efficient heating & air oscar has great customer service skills and definitely knows what he is doing! $150 for any qualified natural gas, propane, or oil furnace or hot water boiler; However, with the credit involving turbines and heat pumps, the remaining $1,200 could be carried over to the following year.

I definitely recommend him if you need any electrical work or heating and air work to be done, just give. The pennsylvania public utility commission (puc) implements act 129, which guides consumers and electric utilities toward achieving reduced energy consumption and peak electric demand. In other words, if you owe $2,200 and your credit is $3,400, you can only claim $2,200 this year.

However, it has been extended through december 31, 2021, and retroactively back to january 1, 2017. If your home system meets the requirements, a tax credit consisting of 30 percent of the cost up to $1,500 is in order. The energy star® designation signifies that the air conditioner has passed the stringent energy efficiency guidelines set by energystar.gov.

Seer>= 16 eer >= 13 package systems: $50 for any advanced main air circulating fan; Gas, propane, or oil furnaces and fans you can qualify for tax credit up to $150.

Appliance retirement incentives pay cash for old fridges, air conditioners, and freezers. Fortunately, there are renewable energy and energy efficiency financial incentives to help. Act 129 electric company energy efficiency programs and rebates.

They must meet or exceed a 95% afue. Is there an energy tax credit for 2020? Meeting the requirements, though, is the condition of receiving this tax credit.

Of that combined $500 limit, turbotax will search over 350 deductions to get your maximum refund, guaranteed. The irs allows you to take the standard deduction. Depending on your circumstances, probably not.

A total combined credit limit of $500 for all tax years after 2005. Taxpayers in virginia may deduct from their taxable personal income an amount equal to 20% of the sales taxes paid for certain energy efficient equipment. However, this credit is limited as follows.

Air conditioners recognized as energy star most efficient meet the requirements for this tax credit. Advanced main air circulating fan you can qualify for tax credit up to $50. Tax credits, rebates & savings.

(link is external) (dsire) for the latest state and federal incentives and rebates. (chances are that older homes have dehumidification, the typical owner response is to units. When you choose to claim a tax credit, you do not have to itemize deductions.

Air conditioning 3 conditioners manufactured after january 23, 2006. A nonrefundable tax credit allows taxpayers to lower their tax liability to zero, but not below zero. Please visit the database of state incentives for renewables & efficiency website.

Heating, ventilating, air conditioning (hvac) as much as half of the energy used in your home goes to heating and cooling. Just remember, you can reduce your taxes with the energy tax credit, but you can�t get money back. This incentive is available for the following equipment types:

Today�s best air conditioners use 30% to 50% less energy to produce the same amount of cooling as air conditioners made in the mid 1970s. This credit is worth a maximum of $500 for all years combined, from 2006 to its expiration. He always answers his phone and is very accommodating with conflicting schedules.

Credits may even be higher for renewable energy, like geothermal systems. If systems are not providing sufficient 17.0 or more. Other programs offered include low cost home energy assessments, free assistance for installing energy efficient products such as shower heads and pipe wrap as well as rebates up to $1,900 for solar and home heating equipment and installation.

Seer >= 14 eer >= 12 see definitions more information. Can you write off a new hvac system on your taxes? So making smart decisions about your home�s heating, ventilating, and air conditioning (hvac) system can have a big effect on your utility bills — and your comfort.

Up to 10% of the cost to $500, or a specific amount from $50 to $300. They must meet or exceed a 95% afue. Cost of a new ac unit.

Advanced main air circulating fan. 10% of the amount paid or incurred for qualified energy efficiency improvements installed during 2020, and any residential energy property costs paid or incurred in 2020. The best available model saves up to $2,104.

For ac’s, the tax credit is worth $300, heat pumps are worth $300, and boilers using gas, propane, or oil are worth $150. He offers great energy efficient options for a great price! If you have an air conditioning system in your home, you may be eligible for a federal tax credit.

The higher the number, the better. You should check for details on the energy star website as the limits are stringent.