In 2018, 2019, 2020, and 2021, an individual may claim a credit for (1) 10% of the cost of qualified energy efficiency improvements and (2) the amount of the residential energy property expenditures paid or incurred by the taxpayer during the taxable year (subject to the overall credit limit of $500). Any insulation added must be in addition to, not a replacement of, existing insulation.

One out of three two out of three three out of three • hvac/water heating • building envelope reduces overall energy costs off cost of system • lighting

Who energy efficient tax deductions for new construction. You can claim a tax credit for 10% of the cost of qualified energy efficiency improvements and 100% of residential energy property costs. In the interest of promoting sustainability in construction and economic development, the university will consider allocating its section 179d deductions to qualifying designers pursuant to the process outlined in the attached document. A tax deduction of $1.80 per square foot is available to owners of new or existing buildings who install (1) interior lighting;

There are tax credits available for new home construction. This credit is worth a flat $300. Ad turbotax® makes it easy to get your taxes done right.

About form 8908, energy efficient home credit eligible contractors use form 8908 to claim a credit for each qualified energy efficient home sold or leased to another person during the tax year for use as a residence. Idaho residents with homes built or under construction before 2002, or who had a building permit issued before january 1, 2002, qualify for an income tax deduction for 100% of the cost of installing new insulation or other approved energy efficiency improvements in an existing residence. Background in new construction, building systems and working with developers is critical and mechanical or energy engineering, sustainability and/or energy efficiency expertise is preferred.

Energy efficiency requirements home builders are eligible for a $2,000 tax credit for a new energy efficient home that achieves 50% energy savings for heating and cooling over the 2006 international energy conservation code (iecc) and supplements. These savings are calculated from the energy used for the lighting, heating, cooling, ventilating, and hot water systems only. Or (3) heating, cooling, ventilation, or hot water systems that reduce the energy and power cost of the interior lighting, hvac, and service hot water systems by 50% or more in comparison to a building meeting.

A credit is used to reduce the amount you pay, and a deduction reduces your total taxable income. Any insulation added must be in addition to, not a replacement of, existing insulation. There’s also no upper limit on how much you can claim.

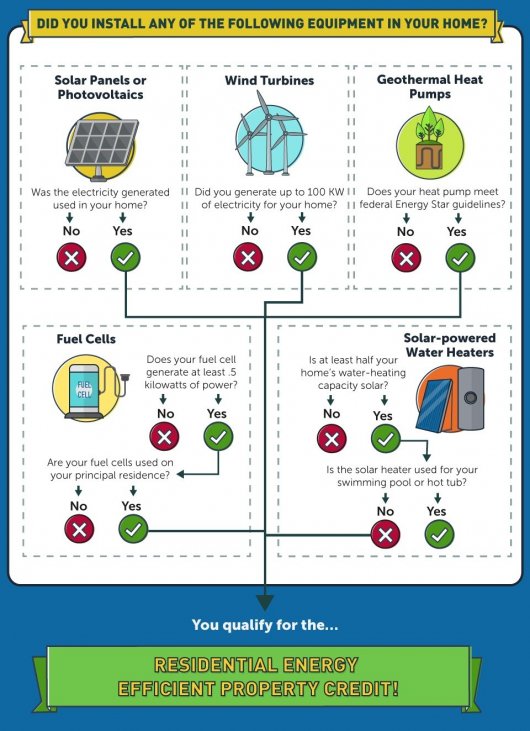

These apply to solar energy systems, wind turbines, and geothermal heat pumps. To qualify, the building must meet energy efficiency standards mandated by the irs. Deductions of up to $.60/s/f for each of the three categories of building envelope, interior lighting and hvac/hot water are possible, for up to $1.80/s/f for new construction or gut rehab.

Current revision form 8908 pdf instructions for form 8908 (print version) pdf recent developments none at this time. These green tax credits were extended, and if you make the purchase and installation before december 31 st, 2019, you can claim back 30% of the total purchase and installation price. Answer simple questions about your life and we do the rest.

At least 1/5 of the energy savings has to come from building envelope improvements. They come in the form of tax deductions and tax credits. Building owners can qualify for deductions ranging from 60 cents to $1.80 per square foot for buildings that are constructed or renovated to save from 10% to 50% on total annual energy costs.

Improvements • offices • retail stores. This credit is worth a maximum of $500 for all years combined, from 2006 to its expiration. In addition, anything that reduces air loss, weather stripping,.

Incentives are provided for qualified equipment installed in a retrofit, major renovation, or new construction project in four categories: In addition, most states and local. Section 179d specifically allows taxpayers to claim a deduction of up to $1.80 per square foot on government buildings, where work was done to make them more energy efficient.

Of that combined $500 limit, turbotax will search over 350 deductions to get your maximum refund, guaranteed. Furnaces, process boilers, water heaters, and high efficiency commercial They must also come with a thermal efficiency of 90% or up.

In 2018, 2019, 2020, and 2021, an individual may claim a credit for (1) 10% of the cost of qualified energy efficiency improvements and (2) the amount of the residential energy property expenditures paid or incurred by the taxpayer during the taxable year (subject to the overall credit limit of $500). Owners to qualify for the tax deductions. Home insulation products may also qualify for a tax credit if they meet energy star standards.

One out of three two out of three three out of three • hvac/water heating • building envelope reduces overall energy costs off cost of system • lighting The building needs to show 10% energy and power cost savings for envelop e improvements, 20% for lighting improvements, and 20% for hvac improvements. Utilizing internal revenue code section 179d, building owners are able to claim a tax deduction of up to $1.80 per square foot (sf), adjusted for inflation, for installing energy efficient systems in either new construction, rehabilitation or remodel/retrofits of commercial buildings, and residential properties with four stories or more.