The program is known as energy star. One out of three two out of three three out of three • hvac/water heating • building envelope reduces overall energy costs off cost of system • lighting

At least 1/5 of the energy savings has to come from building envelope improvements.

Why energy efficient tax deductions for new construction. There’s no upper limit on this tax credit, and you can claim back 30% of the cost. When you install a new furnace in your home, it may prove more than an efficient heating system. If the system or building is installed on federal, state, or local government property, the 179d tax deduction may be taken by the.

The 179d commercial buildings energy efficiency tax deduction primarily enables building owners to claim a tax deduction for installing qualifying systems and buildings. Tax deductions for energy efficient commercial buildings allowed under section 179d of the internal revenue code were made permanent under the consolidated appropriations act of 2021. The residential energy property credit is nonrefundable.

This credit is worth a maximum of $500 for all years combined, from 2006 to its expiration. This tax credit can also be taken when installing a pump in a second home. Credits are claimed when you file taxes for the previous year, so if you made a purchase in 2014, you would be claiming your tax credit now when you file your taxes.

The program is known as energy star. Geothermal heat pumps utilize the heat coming from the earth, so they’re some of the most efficient upgrades you can make. Renewable energy tax credits for fuel cells, small wind turbines, and.

If less than 80% of the use of an item is for nonbusiness purposes, only that portion of the costs that is allocable to the nonbusiness use can be used to determine either credit. If your new heater qualifies, you may receive up to a $150 tax credit on your federal income tax form. One out of three two out of three three out of three • hvac/water heating • building envelope reduces overall energy costs off cost of system • lighting

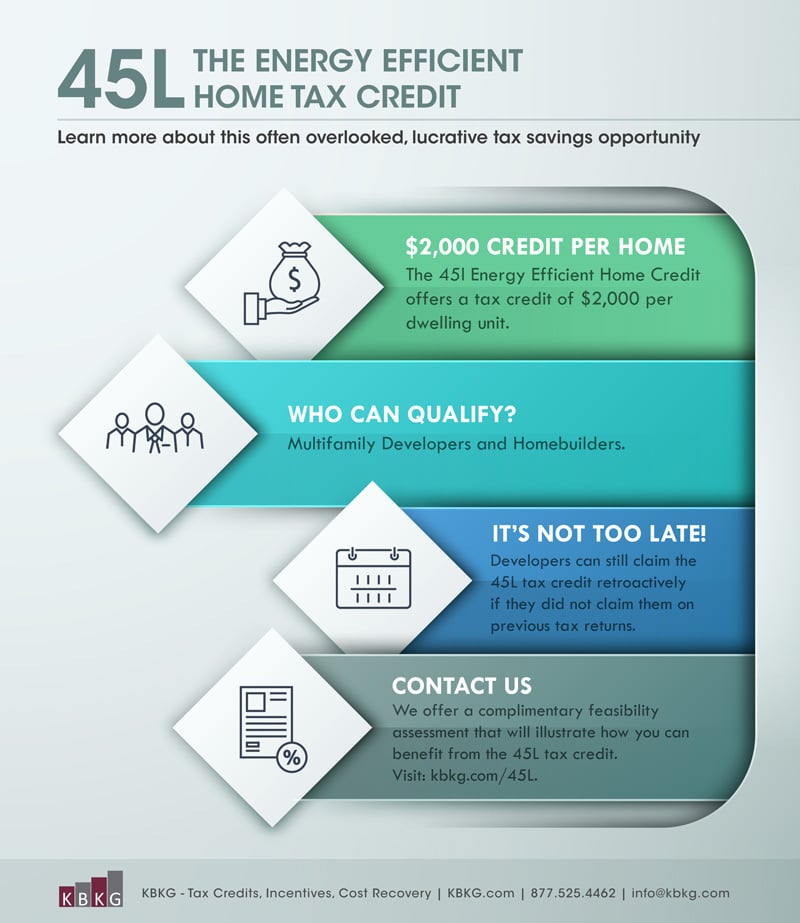

Of that combined $500 limit, A range of tax credits for new home construction can alleviate some of the associated costs. Up to 6% cash back the first is a $2,000 tax credit.

The energy policy act of 2005 allows building owners to receive a tax deduction (codified in the 26 u.s.c. A tax credit is subtracted from the amount of tax that you owe. A nonrefundable tax credit allows taxpayers to lower their tax liability to zero, but not below zero.

You can claim a tax credit for 10% of the cost of qualified energy efficiency improvements and 100% of residential energy property costs. New buildings constructed today will qualify for the deduction if the building meets current codes that exceed the law’s energy efficiency requirements. Energy efficiency requirements home builders are eligible for a $2,000 tax credit for a new energy efficient home that achieves 50% energy savings for heating and cooling over the 2006 international energy conservation code (iecc) and supplements.

Oregon offers industry the largest number of tax incentives specifically aimed at improving energy efficiency. There are two types of tax breaks available to you: Page 2 | federal energy efficiency tax incentives domestic product in 2050 by $100 billion to $200 billion, and support 1.3 million to 1.9 million jobs.3 energy efficiency also can have a.

The tax credits for residential renewable energy products are now available through december 31, 2023. For purposes of the residential energy efficient property credit only, costs connected with the construction of a home are treated as being paid when your original use of the constructed home begins. The other available credit is a $1,000 one for producers of new.

Tenants may be eligible if they make construction expenditures. Tax deductions and tax credits. In addition, most states and local.

Learn more about this program and how. To qualify, the new construction must achieve 50% energy savings from heating and air conditioning over the 2006 code requirements, and at least 20% of that savings must come from the building envelope — the separation barrier between inside and outside. Owners to qualify for the tax deductions.

However, beginning in 2012, the program has mostly expired except for credits geared at the production of residential energy. Improvements • offices • retail stores. Previously, many of the energy efficiency tax credits expired at the end of 2013.

At least 1/5 of the energy savings has to come from building envelope improvements.