In addition, any furnaces using natural gas, oil, or propane can yield a $150 tax credit. If the building does not meet the 50% energy savings requirement, it may still qualify for a partial deduction of 60 cents per square foot if.

The type of credit you.

Without energy efficient tax deductions for new construction. For homeowners, this kind of guidance is essential in the wake of all the changes ushered in by the new tax plan, the 2017 tax cuts and jobs. You should check for details on the energy star website as the limits are stringent. The credit is equal to $2,000, with certain manufactured homes qualifying for a $1,000 credit.

Renewable electricity projects can generate more jobs than the construction and. If your new heater qualifies, you may receive up to a $150 tax credit on your federal income tax form. Equipment and materials can qualify for the nonbusiness energy property credit.

Buying or building a new house is an expensive and complicated transaction. Dear patty, yes, you may qualify for the credit and you are going to need to look at form 5695, residential energy credits. Tax deductions for commercial building owners.

Alternative energy tax incentives alternative energy systems income tax credit: Up to 6% cash back the first is a $2,000 tax credit. For ac’s, the tax credit is worth $300, heat pumps are worth $300, and boilers using gas, propane, or oil are worth $150.

Or (3) heating, cooling, ventilation, or hot water systems that reduce the energy and power cost of the interior lighting, hvac, and service hot water systems by 50% or more in comparison to a building meeting minimum. There are two types of tax breaks available to you: If you and your spouse both paid for the system, and the cost is $1,000 or

This document describes the tax deduction provision in general:. For instance, according to the national association of home builders. A nonrefundable tax credit allows taxpayers to lower their tax liability to zero, but not below zero.

The building needs to show 10% energy and power cost savings for envelop e improvements, 20% for lighting improvements, and 20% for hvac improvements. Although the federal government web site refers taxpayers to energy star information (see www.energystar.gov), not all equipment with the energy star label qualifies for these credits.look for the manufacturer’s tax certification. Deductions of up to $.60/s/f for each of the three categories of building envelope, interior lighting and hvac/hot water are possible, for up to $1.80/s/f for new construction or gut rehab.

In addition, any furnaces using natural gas, oil, or propane can yield a $150 tax credit. The type of credit you. The net reduction in tax expenses equals $153 or a 45 percent reduction in tax payments.

The tax credit is available for homes built/manufactured in the united states between january 1, 2018, and december 31, 2021. That means if you made any qualifying home improvements in 2017. When you install a new furnace in your home, it may prove more than an efficient heating system.

Welcome to your home tax deduction checklist! Common tax deductions for new house construction. While the build back better act�s smorgasbord of tax incentives for clean energy, new taxes on large corporations and wealthy individuals, and tax relief for others remains stalled for now in the senate, 2022 nonetheless dawns with the advent of at least one new tax provision, lapses of a number of others, and at least a couple of sets of required regulatory rules.

A $500 income tax credit is available to individuals living and paying taxes in montana who have installed a new alternative energy system in their primary dwelling. The energy policy act of 2005 allows building owners to receive a tax deduction (codified in the 26 u.s.c. Projects completed between december 31, 2005 and december 31, 2013 are eligible and benefits may be carried forward 15 years.

To qualify, the new construction must achieve 50% energy savings from heating and air conditioning over the 2006 code requirements, and at least 20% of that savings must come from the building envelope — the separation barrier between inside and outside. Without prompt extensions of the tax credits, renewable energy project work stoppages could cost 116,000 jobs. If the building does not meet the 50% energy savings requirement, it may still qualify for a partial deduction of 60 cents per square foot if.

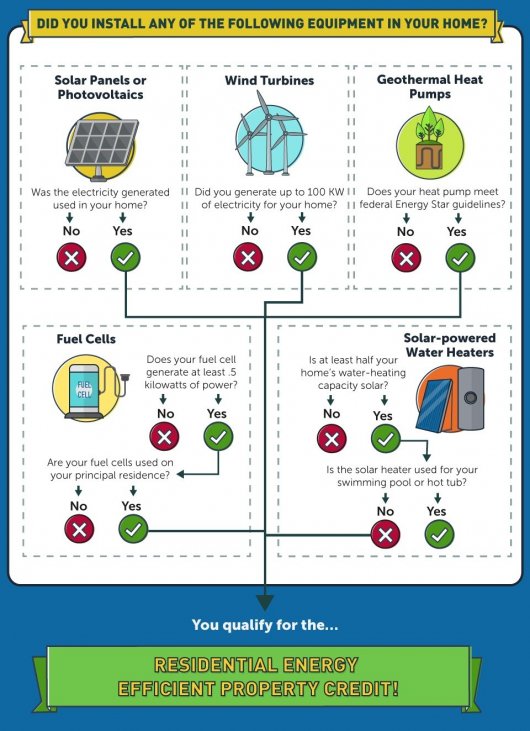

Tax deductions and tax credits. The other available credit is a $1,000 one for producers of new. Department of energy, you can claim the residential energy efficiency property credit for solar, wind, and geothermal equipment in both your principal residence and a second home.

Federal income tax credits and other incentives for energy efficiency **please note: A tax deduction of $1.80 per square foot is available to owners of new or existing buildings who install (1) interior lighting; The current tax credits for residential energy efficiency (equipment tax credits for primary residences) as well as the tax credit for builders of energy efficient homes expired on december 31, 2021.as of january 5, 2022, there is no approved extension of these tax credits.

A range of tax credits for new home construction can alleviate some of the associated costs.